Editor's note: Corporate news update for end April to mid July and early Sep to end Dec 2016 are available on customised; likewise for 2017 news. Updates here are on selected news only.

On corporate issues

Felda could lose RM200m Jalan Semarak land following 'dubious deal' By CHE WAN BADRUL ALIAS - December 21, 2017 https://www.nst.com.my/news/nation/2017/12/316783/felda-could-lose-rm200m-jalan-semarak-land-following-dubious-deal\

More dodgy land transfers for Felda, says report, 21 Dec 2017 https://www.themalaysianinsight.com/s/28691/

Reactions:

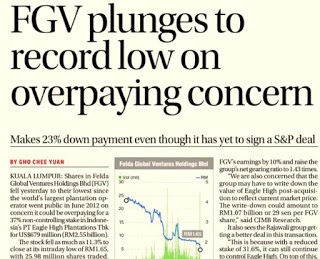

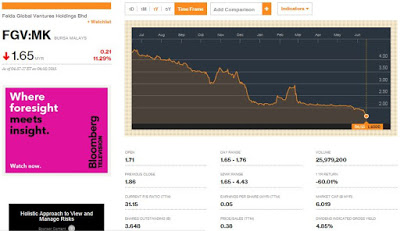

Newsbreak: FGV investigating overpriced Asian Plantations purchase, The Edge Malaysia December 18, 2017 http://www.theedgemarkets.com/article/newsbreak-fgv-investigating-overpriced-asian-plantations-purchase

FGV appoints Salmiah, Mohamed Nazeeb as directors 31 October 2017 http://www.thesundaily.my/news/2017/10/31/fgv-appoints-salmiah-mohamed-nazeeb-directors

Zakaria to resume duties as FGV CEO on Oct 16 By NST Business - October 9, 2017 https://www.nst.com.my/business/2017/10/289201/zakaria-resume-duties-fgv-ceo-oct-16

MACC wrapping up probe on FGV’s ex-chairman Isa Samad September 12, 2017 http://www.themalaymailonline.com/malaysia/article/macc-wrapping-up-probe-on-fgvs-ex-chairman-isa-samad#VjD2zuvi4KUooJOx.99

Two FGV directors to remain despite stating wish to resign — Sulaiman by Sulhi Azman theedgemarkets.com July 13, 2017 http://www.theedgemarkets.com/article/two-fgv-directors-remain-despite-stating-wish-resign-%E2%80%94-sulaiman

The rise and spectacular fall of Isa 25 Jun 2017 by joceline tan https://www.thestar.com.my/opinion/columnists/analysis/2017/06/25/the-rise-and-spectacular-fall-of-isa-tan-sri-mohd-isa-samads-old-school-style-of-politics-helped-him/#2FARBxVMfkC3Ip1E.99

Group calls for revamp of FGV’s board of directors June 24, 2017 http://www.themalaymailonline.com/malaysia/article/group-calls-for-revamp-of-fgvs-board-of-directors#u05m89rXb5oyujwD.97

On Felda settler incentives

Putrajaya, where’s the money, ask Felda settlers by Sheridan Mahavera 20 Sep 2017 https://www.themalaysianinsight.com/s/15321/

Incentives prove govt's commitment to help Felda settlers 2 August 2017 http://www.thesundaily.my/news/2017/08/02/incentives-prove-govts-commitment-help-felda-settlers

Najib announces six incentives for Felda settlers 23 Jul 2017 https://www.thestar.com.my/news/nation/2017/07/23/najib-announces-six-incentives-for-felda-settlers/#04aCuDg3VLuxBgrb.99

Najib: Each Felda settler to get RM5,000 cash incentive 23 Jul 2017 Read more at https://www.thestar.com.my/news/nation/2017/07/23/felda-settlers-to-get-cash-incentive-scheme/#6pWjMuI2WSLO4SIT.99

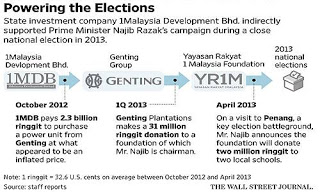

Najib hands out $510m to his Felda Malay vote bank JUL 24, 2017 http://www.straitstimes.com/asia/se-asia/najib-hands-out-510m-to-his-felda-malay-vote-bank

Incentives futile as settlers’ debt too high, says association FMT Reporters | July 25, 2017 http://www.freemalaysiatoday.com/category/nation/2017/07/25/incentives-futile-as-settlers-debt-too-high-says-association/

Najib’s RM1.6b wooing of Felda settlers wrong 25 Jul 2017 https://www.malaysiakini.com/columns/389687

On Felda settler debts

Only 20 years to pay off debt, Felda tells settlers by Zulkifli Sulong, Diyana Ibrahim, Asila Jalil 25 Nov 2017 https://www.themalaysianinsight.com/s/24430/

Felda settlers saddled with debts while replanting, says group 7 Aug 2017 https://www.themalaysianinsight.com/s/9895/

Felda settlers deny being heavily in debt Bernama | July 23, 2017 http://www.freemalaysiatoday.com/category/nation/2017/07/23/felda-settlers-deny-being-heavily-in-debt/

Felda settlers owe almost RM5b in various debts 3 Apr 2017 https://www.malaysiakini.com/news/377832

Rafizi: Felda taking on debt to pay bonus to settlers 5 Jan 2017 https://www.malaysiakini.com/news/368206#fz4jvUh8OBqvZZtx.99

Zakaria has till noon today to reply to FGV’s show-cause letter by Adam Aziz/The Edge Financial Daily June 23, 2017 -- Instead of the 40 more days he asked for, suspended president and chief executive officer of Felda Global Ventures Holdings Bhd (FGV) Datuk Zakaria Arshad has only three more days to reply to a show-cause letter regarding alleged procedural improprieties at a subsidiary of the plantation group.... http://www.theedgemarkets.com/article/zakaria-has-till-noon-today-reply-fgvs-showcause-letter

Govt confirms Sulaiman to head FGV, Isa to lead SPAD 19 June 2017 - The Government has confirmed that Tan Sri Sulaiman Mahbob will be acting chairman of Felda Global Ventures Holdings Bhd (FGV) with immediate effect from Monday while Tan Sri Isa Samad will be acting chairman of the Land Public Transport Commission (SPAD)... http://www.thestar.com.my/business/business-news/2017/06/19/fgv-to-appoint-sulaiman-mahbob-as-chairman-replacing-isa/#JSXqDA4zA8WuLxxI.99

Editor's note: Issues at key plantation Malaysia GLC/SOE seen in escalating headlines on likely expanded investigation by SPRM (Malaysian Anti-Corruption Commission, http://www.sprm.gov.my/index.php/en/, is on a rising trend with investigations; akin to but still in catch-up to the perceived independence of Indonesia's KPK - now in a tussle with Indonesia's Parliament). Although PM Najib appointed Idris Jala as independent reviewer, corporate observers immediately questioned his locus standi in relation to problems at a public-listed entity (see social media snapshot below; and this was acknowledged by PM Najib's key principles to resolving the crisis in Bernama report). KL observers will be eyeing the headlines at key UMNO-linked media (New Straits Times/NST and especially Malay language Utusan Melayu), and pro-Najib administration bloggers such as Raja Petra's Malaysia Today. Experts say to watch out for the breadth of investigations and concerns of how this affects FGV's Isa political positioning in the run-up to General Elections (a narrower investigation could trigger shifts, but a broader investigation may not meed PM Najib's hopes for the investigation to end by the end of the Ramadan month). Felda voters are the bulwark for UMNO-BN.

Source: Recent social media notes on editorial by The Edge Malaysia; with issues of legality and corporate governance also reflected here: "Prime Minister Datuk Seri Najib Tun Razak outlined three key principles to resolve the crisis of Felda Global Ventures Holdings Bhd (FGV) and wants the issue resolved in the month of Ramadan as well... "First, it (the investigation) must comply with company law. Second, it must be consistent with good governance and thirdly, the investigation process must go through a fair process," ... According to Najib, the appointment of former Minister in the Prime Minister's Department Datuk Seri Idris Jala as an independent party to tackle the crisis hit FGV, is guided by three principles.... For now, he said, he was still negotiating with Felda chairman Tan Sri Shahrir Abdul Samad to determine the future of FGV..." in Najib Garis Tiga Prinsip Selesaikan Kemelut FGV, Mahu Isu Diselesai Segera, KULAI, 10 Jun (Bernama) http://www.bernama.com/bernama/v8/bm/newsindex.php?id=1363513

2 groups join calls urging FGV’s Isa to resign by Amin Iskandar Updated 30 minutes ago · Published on 13 Jun 2017 2:56PM FELDA Global Venture Holdings Bhd (FGV) chairman Isa Samad is facing more calls to resign the post amid an ongoing anti-graft investigation. Parti Pribumi Bersatu Malaysia (Bersatu) Felda task force and Pertubuhan Peneroka Rakyat Malaysia (PPRM) today handed a memorandum to Isa, asking him to quit. “FGV has lost around RM13.4 billion since 2012 and Isa should resign for failing to manage FGV and Felda properly,” said Bersatu’s Felda task force chairman Wan Mohd Shahrir Wan Abdul Jalil. https://www.themalaysianinsight.com/s/4982/

Felda chairman to discuss FGV saga with PM tomorrow Updated about 5 hours ago · Published on 13 Jun 2017 10:41AM https://www.themalaysianinsight.com/s/4954/

Isa Samad juga akan dipanggil, Bagi memberi penjelasan kepada SPRM tentang kemelut FGV by Maszureen Hadzman 11 Jun 2017 3:00 AM Artikel Penuh: http://www.utusan.com.my/berita/jenayah/isa-samad-juga-akan-dipanggil-1.491964#ixzz4jqqX9bvP

© Utusan Melayu (M) Bhd

FGV: Lebih 50 individu akan dipanggil SPRM, Bantu siasatan melibatkan pengurusan tertinggi by Nazwin Nazri 13 Jun 2017 3:00 AM Artikel Penuh: http://www.utusan.com.my/berita/jenayah/fgv-lebih-50-individu-akan-dipanggil-sprm-1.492664#ixzz4jqqN7dGZ © Utusan Melayu (M) Bhd, https://www.utusan.com.my/berita/jenayah/fgv-lebih-50-individu-akan-dipanggil-sprm-1.492664

Raja Petra Kamarudin – http://www.malaysia-today.net/; various articles on FGV, e.g.

FGV’S SHOCK RM11BIL LOSS IN JUST 5 YEARS: NO, IT’S NOT DUE TO NAJIB & ROSMAH – IT’S DUE TO ISA & HIS WIFE ‘FLYING FIRST CLASS ALL OVER THE WORLD & CHARGING IT TO FELDA’: NAJIB SPINNERS BLAME SCAPEGOAT, June 10, 2017

Felda Sayong settlers still with Umno, FGV mess or not by Muzliza Mustafa 11 Jun 2017 11:00AM

And despite the issues surrounding FGV, the settlers The Malaysian Insight spoke to last night at Felda Sayong had this to say – they were grateful to Umno for all that they have done. "I paid RM1 and I got 10 acres of land nearly 40 years ago. The earning I receive I get to feed my eight children. If not for Umno I will not be having any of this," she said. The single mother from Felda Simpang Waha was among thousands of settlers who had attended the breaking fast event with Najib at Felda Sayong last night.... https://www.themalaysianinsight.com/s/4773/

Editor's note: NSTP carries negative headlines on Isa, but this is not present in Utusan Malaysia news headlines so far. Minor point, that ineligible family travel flights got a top executive dismissed at Malaysia Airlines (another Malaysia GLC/SOE).

More witnesses, individuals to be questioned in FGV probe: MACC By FAIRUZ MOHD SHAHAR - June 9, 2017, One of MACC’s focus areas was on alleged abuse of power by the top official who had allowed FGV to foot his wife’s travels on first-class flights although she was not entitled to such benefits... https://www.nst.com.my/news/nation/2017/06/247275/more-witnesses-individuals-be-questioned-fgv-probe-macc

FGV tussle: MACC expected to probe six areas-- By ALIZA SHAH AND TASNIM LOKMAN - June 9, 2017 @ 11:38am KUALA LUMPUR: GRAFTBUSTERS looking into possible misconduct and abuse of power in Felda Global Ventures Holdings Bhd (FGV) are expected to probe into at least six areas that would warrant their attention. Sources from the government-linked company told the New Straits Times that it was clear at the end of the Malaysian Anti-Corruption Commission’s (MACC) eight-hour search in Menara Felda what the officers came for. The graftbusters, they said, took with them papers that would shed light on several “clearly contentious” issues, which the sources said were linked to, among others, one of FGV’s top officials. The documents, the NST was told, included those dating back to 2013. https://www.nst.com.my/news/exclusive/2017/06/247206/fgv-tussle-macc-expected-probe-six-areas

'Stop appointing politicians to GLC posts' By ALIZA SHAH - June 9, 2017 https://www.nst.com.my/news/nation/2017/06/247249/stop-appointing-politicians-glc-posts

Settlers group wants Isa to resign By NST - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/247024/felda-settlers-group-wants-isa-resign

Isa should have resigned 'a long time ago', says Muhyiddin on FGV tussle By ARFA YUNUS - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/247002/isa-should-have-resigned-long-time-ago-says-muhyiddin-fgv-tussle

Government starts independent probe on FGV By TASNIM LOKMAN - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/246998/government-starts-independent-probe-fgv

What FGV needs is full audit probe, not Idris Jala by Tony Pua, 9 Jun 2017 https://www.malaysiakini.com/news/385036#ixzz4jYkY2IJB

FGV tussle: Zakaria to get showcause letter once internal probe completed, says Isa By TASNIM LOKMAN - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/246943/fgv-tussle-zakaria-get-showcause-letter-once-internal-probe-completed

Zakaria: FGV’s board, too, should be accountable by Adam Aziz / The Edge Financial Daily June 07, 2017 -- Zakaria also said that he had not seen the irregularities found by FGV’s auditor PwC. “I haven’t seen PwC’s report [why I am implicated]. What are the specifics?” he said.

“As far as I know, PwC conducted a normal audit for the first quarter of 2017. We at the board meeting then unanimously agreed to look into a few irregularities in the audit report, which is a normal process. “But the subsequent meetings, [there were] three of them, were done without me being present,” he added. He said that Felda, as the largest shareholder of FGV, had requested for the matter to be managed within the business operations units of the company, and not the current corporate level. “I did not invite the press, nor did I leak my letter [to Isa] as people claimed I did. Now that the word is out, Felda is very concerned as it has affected FGV’s share price significantly,” he said.... Earlier, Zakaria told the media that any investigation in FGV should concentrate on the company’s procurement body. “On paper, our procurements may look great. But try to see beyond that, beyond the approvals. “Not all of the company’s procurements and purchases go through me. There are different levels [involved]. You have to also look at people who play the smaller roles … not forgetting certain ‘invisible hands’,” he said....The investigation is another blow to FGV, which is rife with allegations of poor management decisions. With the general election round the corner, FGV will need to provide a clearer picture soon lest the issue unsettles its biggest shareholder, who should be scrutinising its every move.

http://www.theedgemarkets.com/article/zakaria-fgvs-board-too-should-be-accountable

'Siapa undi Najib, dapat banyak' ('Who votes Najib, can get a lot') by Sinar TV Published on 8 Jun 2017 Pengerusi Felda Global Ventures Holdings Berhad (FGV), Tan Sri Isa Samad berjenaka, siapa yang tetap menyokong kepimpinan Datuk Seri Najib Tun Razak mungkin boleh menikmati keuntungan FGV pada masa depan. https://www.youtube.com/watch?v=-49db_36mOE&feature=youtu.be

Zakaria is giving a good fight, expect more dirt to be revealed by Yoursay Published 8 Jun 2017 Read more: https://www.malaysiakini.com/news/384905#ixzz4jURoZvkJ

Felda CEO won't comply with chairman request to resign - letter. Reuters | Published on June 06, 2017 -- A spokesman for Felda Global, the world's third largest palm plantation operator, said that the board had asked for Zakaria to take a leave of absence effective immediately. In the letter, dated June 5, Zakaria said he had been accused of wrongdoing in payments to a Afghan company that Felda Global had done business with. "The chairman has asked that I resign as president and FGV group chief executive due to accusations that I have violated corporate governance code," he said in the letter. "The payment process... was approved and implemented by the previous chief executive... I am not guilty of those accusations and will not resign as instructed."..

http://english.astroawani.com/business-news/felda-ceo-wont-comply-chairman-request-resign-letter-145206

Suspended FGV CEO says he tried to stop 'ridiculous' investments 6 Jun 2017, 5:37 pm -- Amongst the investments, he said, was plans for a 100 million pound sterling (approximately RM551 million) expansion of Felda Cambridge Nanosystems Ltd, a nano carbon company, which had already lost RM117 million in the last three to four years. "Now they (the FGV board) want to expand, they need another 100 million pounds. To me this is ridiculous, we're a plantation company," he was quoted as saying by The Star. Another investment, Zakaria said, was the plan to spend RM300 million to acquire a 30 percent stake in a creamer factory, owned by a company primarily involved in making cans... https://www.malaysiakini.com/news/384750#ixzz4jEeUBpb6

MACC prepared to probe FGV for graft - Azam Baki June 06, 2017 http://english.astroawani.com/malaysia-news/macc-prepared-probe-fgv-graft-azam-baki-145283

FGV suspends group president and CFO 6 June 2017 -- http://www.thestar.com.my/business/business-news/2017/06/06/fgv-zakaria-arshad-suspended/#LmJrOXuiWHmR3lPX.99

Isa threatens to sue reporter over 'abuse of power' poser by Anne Muhammad 6 Jun 2017, 4:44 pm https://www.malaysiakini.com/news/384734#ixzz4jEfKy7DG

The Star employee charged with receiving bribes from FGVH CEO 5 Jun 2017 -- An employee of The Star newspaper was charged in the Kuala Lumpur Sessions Court this morning with receiving RM20,000 in bribes. M Youganesparan was accused of receiving the money from former Felda Global Ventures Holdings Bhd (FGVH) chief executive officer Mohd Emir Mavani Abdullah at The Intermark Hotel, Jalan Tun Razak about 9.15pm on May 30 this year. http://m.malaysiakini.com/news/384588

Felda Global chairman says parent firm not involved in suspension of CEO Reuters | Published on June 06, 2017 http://english.astroawani.com/business-news/felda-global-chairman-says-parent-firm-not-involved-suspension-ceo-145225

Shahrir hampa 'suara' FELDA dipinggirkan SELASA, 6 JUN 2017 - 9:38AM http://www.bharian.com.my/node/290120?m=1

WHY ISA SAMAD WANTS TO GET RID OF ZAKARIA ARSHAD June 3, 2017 by Raja Petra Kamarudin http://www.malaysia-today.net/why-isa-samad-wants-to-get-rid-of-zakaria-arshad/

Sturgeon-farming project: How Felda 5 beat the system By ALIZA SHAH - January 26, 2017 https://www.nst.com.my/news/2017/01/207460/sturgeon-farming-project-how-felda-5-beat-system

Felda firm's ex-CEO, director charged with CBT 2 Aug 2013 https://www.malaysiakini.com/news/237515

Indonesian Palm Oil's Stranded Assets: 10 Million Football Fields Feb. 15 2017, Gabriel Thoumi, Chain Reaction Research, https://seekingalpha.com/article/4046193-indonesian-palm-oils-stranded-assets-10-million-football-fields - Four detailed case studies presented: Noble Group, Eagle High Plantations, Provident Agro and Tadmax.

Upcoming financial results, deforestation charge weigh on FGV 27 May 2017 Read more at http://www.thestar.com.my/business/business-news/2017/05/27/upcoming-financial-results-deforestation-charge-weigh-on-fgv/#JFPxpj0W4vyU6VSf.99

Ali Bongo a inauguré l’Usine d’huile de palme d’Olam à Mouila http://www.gabonactu.com/ali-bongo-a-inaugure-lusine-dhuile-de-palme-dolam-a-mouila/

Gabon context:

Palm Oil Giant Denies Covering up Labor Abuses in Indonesia By : Beh Lih Yi | March 08, 2017 -- Amnesty said in a statement on Tuesday that Wilmar — the world's largest palm oil processor — had asked its workers to sign a document to deny the investigation findings during a recent meeting with trade union representatives. Wilmar rejected the claim and said the union representatives had "voluntarily" signed the letters as "a show of support" to the company. http://jakartaglobe.id/news/palm-oil-giant-denies-covering-labor-abuses-indonesia/

FGV earnings down, closing 4 palm oil mills, 2 rubber factories, 1refinery BY AFIQ ISA 1 March 2017 Read more at http://www.thestar.com.my/business/business-news/2017/03/01/fgv-fullyear-earnings-fall-on-rationalisation-oneoffs/#7d95AySK8WmB17Cq.99

National park fights back against illegal plantations by Apriadi Gunawan The Jakarta Post http://www.thejakartapost.com/news/2017/03/11/national-park-fights-back-against-illegal-plantations.html

FGV: KPF share sale a non-issue BY AFIQ ISA 9 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/09/fgv-kpf-share-sale-a-nonissue/#S5K44jKsR9ZIE4Hd.99

Malaysia's Sime Darby to Spin off Plantation, Property Businesses By : Emily Chow | on 9:00 AM January 27, 2017 http://jakartaglobe.id/international/malaysias-sime-darby-spin-off-plantation-property-businesses/

CB Industrial group files RM8.4mil claim against TDM subsidiary BY M. HAFIDZ MAHPAR 9 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/09/cb-industrial-group-files-rm8pt4mil-claim-against-tdm-subsidiary/#xLR4OJH8e5fdkDHS.99

Indonesia - Government wins in forest fire case by Hans Nicholas Jong The Jakarta Post Jakarta | Thu, February 9, 2017 -- In the fight against deforestation and forest fires, the Environment and Forestry Ministry is on a winning streak, with the courts ruling in favor of the government in cases against companies. Still, the enforcing of penalties remains weak.... In its latest victory, the South Jakarta District Court found palm oil company PT Waringin Agro Jaya (WAJ) guilty on Tuesday of illegally starting a forest fire to clear land in Ogan Komering Ilir, South Sumatra. The court ordered the company to pay Rp 466.5 billion (US$35 million), Rp 173.5 billion of which will serve as compensation for the burning of 1,626 hectares of land in its land concession and another Rp 293 billion to cover the rehabilitation cost for the burned land. The fine was lower than the ministry’s demand of Rp 754 billion.... However, none of the companies have paid the fines or compensation. The ministry’s law enforcement director general, Rasio Ridho Sani, acknowledged that it was a challenge for the ministry to enforce verdicts. It takes time for verdicts to be enforced because the ministry has to wait for the official record of the verdict to be available, which can take months to more than a year. Moreover, there is no standard operating procedure for the enforcement of forest-related rulings. The ministry is pushing for the Supreme Court to issue a regulation on its judges to help with the enforcement of penalties....http://www.thejakartapost.com/news/2017/02/09/government-wins-in-forest-fire-case.html

Feature story in The Edge Malaysia weekly, 3 Jan 2017 issue

EPF not to be blamed for leaving FGV BY M. SHANMUGAM 3 January 2017 http://www.thestar.com.my/business/business-news/2017/01/03/epf-not-to-be-blamed-for-leaving-fgv/

Strategi Besar FGV Pasca Pembelian Saham 37% Eagle High Plantation 26 Dec 2016 by Qayuum Amri -- Post this acquisition, FGV will have access to manage 287 thousand hectares of land ...https://www.sawitindonesia.com/rubrikasi-majalah/berita-terbaru/strategi-besar-fgv-pasca-pembelian-saham-37-eagle-high-plantation

Felda says 'no' financial burden from US$505m Eagle High stake buy By Chong Jin Hun / theedgemarkets.com | December 31, 2016 http://www.theedgemarkets.com/en/article/felda-says-no-financial-burden-us505m-eagle-high-stake-buy?type=Corporate

Felda secures Malaysian govt financing for Eagle High stake purchase Dec 28, 2016 http://www.reuters.com/article/malaysia-felda-eagle-high-idUSL4N1EO18M

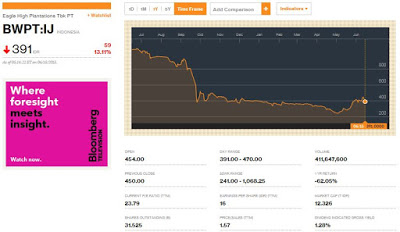

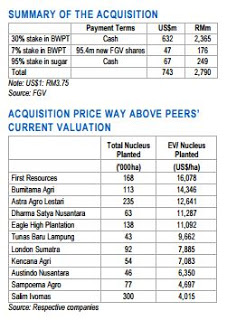

FGV continues dip after Felda's US$505.4m Eagle High buy By Sangeetha Amarthalingam / theedgemarkets.com | December 29, 2016 http://www.theedgemarkets.com/my/article/fgv-continues-dip-after-feldas-us5054m-eagle-high-buy On Dec 23, FIC Properties Sdn Bhd (FICP) inked a sale and purchase agreement with PT Rajawali Corp to acquire a 37% stake in Indonesia-listed Eagle High for US$505.4 million (RM2.26 billion).... Initially, FGV was to purchase the stake but talks ended following the advice by its bankers, JPMorgan and Bank of America, to opt out of the deal as the then US$680 million price tag was seen as too high for the 37% Eagle High stake.... The latest acquisition by FICP has stirred analysts and critics who claim that the deal was too expensive and would not derive synergy as Felda does not have a controlling stake in Eagle High.

Felda secures Malaysian govt financing for Eagle High stake purchase By Reuters / Reuters | December 29, 2016 http://www.theedgemarkets.com/my/article/felda-secures-malaysian-govt-financing-eagle-high-stake-purchase

No synergy seen in Felda’s Eagle High buy By Sangeetha Amarthalingam & Chester Tay / The Edge Financial Daily | December 29, 2016 http://www.theedgemarkets.com/my/article/no-synergy-seen-felda%E2%80%99s-eagle-high-buy

Palm oil deal embroiled in Malaysian politics DECEMBER 30, 2016 by: Jeevan Vasagar https://www.ft.com/content/44e04f0a-ccd6-11e6-864f-20dcb35cede2

Felda-Eagle High deal slammed for profiting Indonesia's Rajawali 29 Dec 2016 -- PAS deputy president Tuan Ibrahim Tuan Man pointed out how Indonesian billionaire Peter Sondakh, who owns Rajawali Group, had purchased shares at EHP for 400 rupiah per share. It was estimated that Rajawali Group had spent US$570 million to acquire a 68.6 percent stake in EHP. Read more: https://www.malaysiakini.com/news/367523#ixzz4UFnsoVEB

Rafizi poses questions to PM on Felda-Eagle High Plantations deal Read more: https://www.malaysiakini.com/news/367357#ixzz4UFnZvyRw

News update for 6 Sep to come 30 Dec customised.

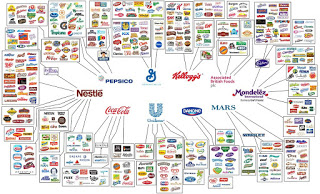

This Infographic Shows How Only 10 Companies Own All The World’s Brands by Kate Ryan -- Credit: Oxfam International. Just when you think there’s no end to the diversity of junk food lining supermarket aisles, an insanely detailed infographic comes along to set us all straight. Out of the hundreds of products at our disposal, only ten major corporations manufacture the bulk of what we toss in our shopping carts. So whether you’re looking to stock up on anything from orange soda to latte-flavored potato chips, Mondelez, Kraft, Coca-Cola, Nestlé, PepsiCo, P&G, Johnson & Johnson, Mars, Danone, General Mills, Kellogg's, and Unilever own just about everything you could hope to buy. It seems that six degrees of separation theory has been proven after all, if only because we all drink Diet Coke every now and then. In order to visually elucidate that point, Oxfam International created a comprehensive infographic that reveals the extensive reach of the “Big 10” food and beverage companies. Unlikely ties between brands we largely don’t associate with one another show how easy it is to be misinformed about the American food system. For example, PepsiCo produces Quaker granola bars, and Nestlé makes Kit Kat bars but also frozen California Pizza Kitchen pies. To the surprise of many, Pineapple Fanta isn’t sourced straight from the mythical Fanta Islands, but canned right alongside Barq’s root beer at the Coca-Cola factory....

https://www.good.is/articles/

22 Dec 2017: More headlines for Felda-FGV. Land deals questioned.

Editor's note: Readers asked for follow-up on what transpired. There's been a lot of circulation of the recent land deals question in social media.On corporate issues

Felda could lose RM200m Jalan Semarak land following 'dubious deal' By CHE WAN BADRUL ALIAS - December 21, 2017 https://www.nst.com.my/news/nation/2017/12/316783/felda-could-lose-rm200m-jalan-semarak-land-following-dubious-deal\

More dodgy land transfers for Felda, says report, 21 Dec 2017 https://www.themalaysianinsight.com/s/28691/

Reactions:

- Najib cannot wash his hands of Felda land scandal, says settlers’ group 24 Dec 2017 -- Mazlan said those involved in the Jalan Semarak land sale were still part of the Felda board of directors. https://www.themalaysianinsight.com/s/29173/

- Deputy minister urges talks with company in shady Felda land deal 24 Dec 2017 -- The company had sold the land to itself for RM270 million and Felda did not receive a sen... Shahrir said Synergy Promenade was given the power of attorney on September 2, 2014 to develop the land on behalf of Felda Investment Corporation, a subsidiary of Felda. The Felda board of directors were only informed of the development months later so that it they give backdated approval... https://www.themalaysianinsight.com/s/29149/

- Felda scandal being used to divert attention from 1MDB, says Isa Samad’s former aide by Amin Iskandar 25 Dec 2017 -- "I am 100% sure that Isa Samad will be charged before GE14. It's to take away attention from issues like 1MDB, SRC and the money going into the prime minister’s accounts ,” Zahid told The Malaysian Insight. “Isa’s arrest is very important to Umno, Najib and Barisan Nasional as it will make people forget about the GST (goods and services tax), the scandals at Mara, Felcra, the Youth and Sports Ministry and the Johor exco,” said Zahid, who is now with opposition party Bersatu. https://www.themalaysianinsight.com/s/29323/

Newsbreak: FGV investigating overpriced Asian Plantations purchase, The Edge Malaysia December 18, 2017 http://www.theedgemarkets.com/article/newsbreak-fgv-investigating-overpriced-asian-plantations-purchase

FGV appoints Salmiah, Mohamed Nazeeb as directors 31 October 2017 http://www.thesundaily.my/news/2017/10/31/fgv-appoints-salmiah-mohamed-nazeeb-directors

Zakaria to resume duties as FGV CEO on Oct 16 By NST Business - October 9, 2017 https://www.nst.com.my/business/2017/10/289201/zakaria-resume-duties-fgv-ceo-oct-16

MACC wrapping up probe on FGV’s ex-chairman Isa Samad September 12, 2017 http://www.themalaymailonline.com/malaysia/article/macc-wrapping-up-probe-on-fgvs-ex-chairman-isa-samad#VjD2zuvi4KUooJOx.99

Two FGV directors to remain despite stating wish to resign — Sulaiman by Sulhi Azman theedgemarkets.com July 13, 2017 http://www.theedgemarkets.com/article/two-fgv-directors-remain-despite-stating-wish-resign-%E2%80%94-sulaiman

The rise and spectacular fall of Isa 25 Jun 2017 by joceline tan https://www.thestar.com.my/opinion/columnists/analysis/2017/06/25/the-rise-and-spectacular-fall-of-isa-tan-sri-mohd-isa-samads-old-school-style-of-politics-helped-him/#2FARBxVMfkC3Ip1E.99

Group calls for revamp of FGV’s board of directors June 24, 2017 http://www.themalaymailonline.com/malaysia/article/group-calls-for-revamp-of-fgvs-board-of-directors#u05m89rXb5oyujwD.97

On Felda settler incentives

Putrajaya, where’s the money, ask Felda settlers by Sheridan Mahavera 20 Sep 2017 https://www.themalaysianinsight.com/s/15321/

Incentives prove govt's commitment to help Felda settlers 2 August 2017 http://www.thesundaily.my/news/2017/08/02/incentives-prove-govts-commitment-help-felda-settlers

Najib announces six incentives for Felda settlers 23 Jul 2017 https://www.thestar.com.my/news/nation/2017/07/23/najib-announces-six-incentives-for-felda-settlers/#04aCuDg3VLuxBgrb.99

Najib: Each Felda settler to get RM5,000 cash incentive 23 Jul 2017 Read more at https://www.thestar.com.my/news/nation/2017/07/23/felda-settlers-to-get-cash-incentive-scheme/#6pWjMuI2WSLO4SIT.99

Najib hands out $510m to his Felda Malay vote bank JUL 24, 2017 http://www.straitstimes.com/asia/se-asia/najib-hands-out-510m-to-his-felda-malay-vote-bank

Incentives futile as settlers’ debt too high, says association FMT Reporters | July 25, 2017 http://www.freemalaysiatoday.com/category/nation/2017/07/25/incentives-futile-as-settlers-debt-too-high-says-association/

On Felda settler debts

Only 20 years to pay off debt, Felda tells settlers by Zulkifli Sulong, Diyana Ibrahim, Asila Jalil 25 Nov 2017 https://www.themalaysianinsight.com/s/24430/

Felda settlers saddled with debts while replanting, says group 7 Aug 2017 https://www.themalaysianinsight.com/s/9895/

Felda settlers deny being heavily in debt Bernama | July 23, 2017 http://www.freemalaysiatoday.com/category/nation/2017/07/23/felda-settlers-deny-being-heavily-in-debt/

Felda settlers owe almost RM5b in various debts 3 Apr 2017 https://www.malaysiakini.com/news/377832

Rafizi: Felda taking on debt to pay bonus to settlers 5 Jan 2017 https://www.malaysiakini.com/news/368206#fz4jvUh8OBqvZZtx.99

23 Jun 2017: Najib administration sticks Ramadan deadline on FGV tussle - CEO has until noon to reply to show-cause letter; Isa voluntarily steps down and promoted to Land Public Transport Commission (SPAD)

Editor's note: The first day of Eid is on SundayZakaria has till noon today to reply to FGV’s show-cause letter by Adam Aziz/The Edge Financial Daily June 23, 2017 -- Instead of the 40 more days he asked for, suspended president and chief executive officer of Felda Global Ventures Holdings Bhd (FGV) Datuk Zakaria Arshad has only three more days to reply to a show-cause letter regarding alleged procedural improprieties at a subsidiary of the plantation group.... http://www.theedgemarkets.com/article/zakaria-has-till-noon-today-reply-fgvs-showcause-letter

Govt confirms Sulaiman to head FGV, Isa to lead SPAD 19 June 2017 - The Government has confirmed that Tan Sri Sulaiman Mahbob will be acting chairman of Felda Global Ventures Holdings Bhd (FGV) with immediate effect from Monday while Tan Sri Isa Samad will be acting chairman of the Land Public Transport Commission (SPAD)... http://www.thestar.com.my/business/business-news/2017/06/19/fgv-to-appoint-sulaiman-mahbob-as-chairman-replacing-isa/#JSXqDA4zA8WuLxxI.99

13 Jun 2017: Escalating headlines on FGV - can this be resolved by the end of Ramadhan?

Editor's note: Issues at key plantation Malaysia GLC/SOE seen in escalating headlines on likely expanded investigation by SPRM (Malaysian Anti-Corruption Commission, http://www.sprm.gov.my/index.php/en/, is on a rising trend with investigations; akin to but still in catch-up to the perceived independence of Indonesia's KPK - now in a tussle with Indonesia's Parliament). Although PM Najib appointed Idris Jala as independent reviewer, corporate observers immediately questioned his locus standi in relation to problems at a public-listed entity (see social media snapshot below; and this was acknowledged by PM Najib's key principles to resolving the crisis in Bernama report). KL observers will be eyeing the headlines at key UMNO-linked media (New Straits Times/NST and especially Malay language Utusan Melayu), and pro-Najib administration bloggers such as Raja Petra's Malaysia Today. Experts say to watch out for the breadth of investigations and concerns of how this affects FGV's Isa political positioning in the run-up to General Elections (a narrower investigation could trigger shifts, but a broader investigation may not meed PM Najib's hopes for the investigation to end by the end of the Ramadan month). Felda voters are the bulwark for UMNO-BN.

Source: Recent social media notes on editorial by The Edge Malaysia; with issues of legality and corporate governance also reflected here: "Prime Minister Datuk Seri Najib Tun Razak outlined three key principles to resolve the crisis of Felda Global Ventures Holdings Bhd (FGV) and wants the issue resolved in the month of Ramadan as well... "First, it (the investigation) must comply with company law. Second, it must be consistent with good governance and thirdly, the investigation process must go through a fair process," ... According to Najib, the appointment of former Minister in the Prime Minister's Department Datuk Seri Idris Jala as an independent party to tackle the crisis hit FGV, is guided by three principles.... For now, he said, he was still negotiating with Felda chairman Tan Sri Shahrir Abdul Samad to determine the future of FGV..." in Najib Garis Tiga Prinsip Selesaikan Kemelut FGV, Mahu Isu Diselesai Segera, KULAI, 10 Jun (Bernama) http://www.bernama.com/bernama/v8/bm/newsindex.php?id=1363513

Source: NST front page, 13 June 2017

2 groups join calls urging FGV’s Isa to resign by Amin Iskandar Updated 30 minutes ago · Published on 13 Jun 2017 2:56PM FELDA Global Venture Holdings Bhd (FGV) chairman Isa Samad is facing more calls to resign the post amid an ongoing anti-graft investigation. Parti Pribumi Bersatu Malaysia (Bersatu) Felda task force and Pertubuhan Peneroka Rakyat Malaysia (PPRM) today handed a memorandum to Isa, asking him to quit. “FGV has lost around RM13.4 billion since 2012 and Isa should resign for failing to manage FGV and Felda properly,” said Bersatu’s Felda task force chairman Wan Mohd Shahrir Wan Abdul Jalil. https://www.themalaysianinsight.com/s/4982/

Felda chairman to discuss FGV saga with PM tomorrow Updated about 5 hours ago · Published on 13 Jun 2017 10:41AM https://www.themalaysianinsight.com/s/4954/

Isa Samad juga akan dipanggil, Bagi memberi penjelasan kepada SPRM tentang kemelut FGV by Maszureen Hadzman 11 Jun 2017 3:00 AM Artikel Penuh: http://www.utusan.com.my/berita/jenayah/isa-samad-juga-akan-dipanggil-1.491964#ixzz4jqqX9bvP

© Utusan Melayu (M) Bhd

FGV: Lebih 50 individu akan dipanggil SPRM, Bantu siasatan melibatkan pengurusan tertinggi by Nazwin Nazri 13 Jun 2017 3:00 AM Artikel Penuh: http://www.utusan.com.my/berita/jenayah/fgv-lebih-50-individu-akan-dipanggil-sprm-1.492664#ixzz4jqqN7dGZ © Utusan Melayu (M) Bhd, https://www.utusan.com.my/berita/jenayah/fgv-lebih-50-individu-akan-dipanggil-sprm-1.492664

Raja Petra Kamarudin – http://www.malaysia-today.net/; various articles on FGV, e.g.

FGV’S SHOCK RM11BIL LOSS IN JUST 5 YEARS: NO, IT’S NOT DUE TO NAJIB & ROSMAH – IT’S DUE TO ISA & HIS WIFE ‘FLYING FIRST CLASS ALL OVER THE WORLD & CHARGING IT TO FELDA’: NAJIB SPINNERS BLAME SCAPEGOAT, June 10, 2017

11 Jun 2017: Felda settlers - much to be grateful for

Felda Sayong settlers still with Umno, FGV mess or not by Muzliza Mustafa 11 Jun 2017 11:00AM

And despite the issues surrounding FGV, the settlers The Malaysian Insight spoke to last night at Felda Sayong had this to say – they were grateful to Umno for all that they have done. "I paid RM1 and I got 10 acres of land nearly 40 years ago. The earning I receive I get to feed my eight children. If not for Umno I will not be having any of this," she said. The single mother from Felda Simpang Waha was among thousands of settlers who had attended the breaking fast event with Najib at Felda Sayong last night.... https://www.themalaysianinsight.com/s/4773/

9 June 2017: FGV tussles - anti-corruption agency grabs files back to 2013, first-class flights, 'invisible hands' in procurement, Felda and the upcoming General Election etc.

Editor's note: NSTP carries negative headlines on Isa, but this is not present in Utusan Malaysia news headlines so far. Minor point, that ineligible family travel flights got a top executive dismissed at Malaysia Airlines (another Malaysia GLC/SOE).

More witnesses, individuals to be questioned in FGV probe: MACC By FAIRUZ MOHD SHAHAR - June 9, 2017, One of MACC’s focus areas was on alleged abuse of power by the top official who had allowed FGV to foot his wife’s travels on first-class flights although she was not entitled to such benefits... https://www.nst.com.my/news/nation/2017/06/247275/more-witnesses-individuals-be-questioned-fgv-probe-macc

FGV tussle: MACC expected to probe six areas-- By ALIZA SHAH AND TASNIM LOKMAN - June 9, 2017 @ 11:38am KUALA LUMPUR: GRAFTBUSTERS looking into possible misconduct and abuse of power in Felda Global Ventures Holdings Bhd (FGV) are expected to probe into at least six areas that would warrant their attention. Sources from the government-linked company told the New Straits Times that it was clear at the end of the Malaysian Anti-Corruption Commission’s (MACC) eight-hour search in Menara Felda what the officers came for. The graftbusters, they said, took with them papers that would shed light on several “clearly contentious” issues, which the sources said were linked to, among others, one of FGV’s top officials. The documents, the NST was told, included those dating back to 2013. https://www.nst.com.my/news/exclusive/2017/06/247206/fgv-tussle-macc-expected-probe-six-areas

'Stop appointing politicians to GLC posts' By ALIZA SHAH - June 9, 2017 https://www.nst.com.my/news/nation/2017/06/247249/stop-appointing-politicians-glc-posts

Settlers group wants Isa to resign By NST - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/247024/felda-settlers-group-wants-isa-resign

Isa should have resigned 'a long time ago', says Muhyiddin on FGV tussle By ARFA YUNUS - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/247002/isa-should-have-resigned-long-time-ago-says-muhyiddin-fgv-tussle

Government starts independent probe on FGV By TASNIM LOKMAN - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/246998/government-starts-independent-probe-fgv

What FGV needs is full audit probe, not Idris Jala by Tony Pua, 9 Jun 2017 https://www.malaysiakini.com/news/385036#ixzz4jYkY2IJB

FGV tussle: Zakaria to get showcause letter once internal probe completed, says Isa By TASNIM LOKMAN - June 8, 2017 https://www.nst.com.my/news/nation/2017/06/246943/fgv-tussle-zakaria-get-showcause-letter-once-internal-probe-completed

Zakaria: FGV’s board, too, should be accountable by Adam Aziz / The Edge Financial Daily June 07, 2017 -- Zakaria also said that he had not seen the irregularities found by FGV’s auditor PwC. “I haven’t seen PwC’s report [why I am implicated]. What are the specifics?” he said.

“As far as I know, PwC conducted a normal audit for the first quarter of 2017. We at the board meeting then unanimously agreed to look into a few irregularities in the audit report, which is a normal process. “But the subsequent meetings, [there were] three of them, were done without me being present,” he added. He said that Felda, as the largest shareholder of FGV, had requested for the matter to be managed within the business operations units of the company, and not the current corporate level. “I did not invite the press, nor did I leak my letter [to Isa] as people claimed I did. Now that the word is out, Felda is very concerned as it has affected FGV’s share price significantly,” he said.... Earlier, Zakaria told the media that any investigation in FGV should concentrate on the company’s procurement body. “On paper, our procurements may look great. But try to see beyond that, beyond the approvals. “Not all of the company’s procurements and purchases go through me. There are different levels [involved]. You have to also look at people who play the smaller roles … not forgetting certain ‘invisible hands’,” he said....The investigation is another blow to FGV, which is rife with allegations of poor management decisions. With the general election round the corner, FGV will need to provide a clearer picture soon lest the issue unsettles its biggest shareholder, who should be scrutinising its every move.

http://www.theedgemarkets.com/article/zakaria-fgvs-board-too-should-be-accountable

'Siapa undi Najib, dapat banyak' ('Who votes Najib, can get a lot') by Sinar TV Published on 8 Jun 2017 Pengerusi Felda Global Ventures Holdings Berhad (FGV), Tan Sri Isa Samad berjenaka, siapa yang tetap menyokong kepimpinan Datuk Seri Najib Tun Razak mungkin boleh menikmati keuntungan FGV pada masa depan. https://www.youtube.com/watch?v=-49db_36mOE&feature=youtu.be

Zakaria is giving a good fight, expect more dirt to be revealed by Yoursay Published 8 Jun 2017 Read more: https://www.malaysiakini.com/news/384905#ixzz4jURoZvkJ

6 June 2017: FGV CEO won't comply with chairman request to resign

Editor's note: Adds to confusing earlier news swirling on FGV potential tie-ups with the likes of COFCO, Martua Sitorus and others; having already been linked to Eagle High at a group level. Various graft investigations on sturgeon and other deals. A journalist allegedly bribed by a former CEO on 30 May and charged within a week on 5 Jun.Felda CEO won't comply with chairman request to resign - letter. Reuters | Published on June 06, 2017 -- A spokesman for Felda Global, the world's third largest palm plantation operator, said that the board had asked for Zakaria to take a leave of absence effective immediately. In the letter, dated June 5, Zakaria said he had been accused of wrongdoing in payments to a Afghan company that Felda Global had done business with. "The chairman has asked that I resign as president and FGV group chief executive due to accusations that I have violated corporate governance code," he said in the letter. "The payment process... was approved and implemented by the previous chief executive... I am not guilty of those accusations and will not resign as instructed."..

http://english.astroawani.com/business-news/felda-ceo-wont-comply-chairman-request-resign-letter-145206

Suspended FGV CEO says he tried to stop 'ridiculous' investments 6 Jun 2017, 5:37 pm -- Amongst the investments, he said, was plans for a 100 million pound sterling (approximately RM551 million) expansion of Felda Cambridge Nanosystems Ltd, a nano carbon company, which had already lost RM117 million in the last three to four years. "Now they (the FGV board) want to expand, they need another 100 million pounds. To me this is ridiculous, we're a plantation company," he was quoted as saying by The Star. Another investment, Zakaria said, was the plan to spend RM300 million to acquire a 30 percent stake in a creamer factory, owned by a company primarily involved in making cans... https://www.malaysiakini.com/news/384750#ixzz4jEeUBpb6

MACC prepared to probe FGV for graft - Azam Baki June 06, 2017 http://english.astroawani.com/malaysia-news/macc-prepared-probe-fgv-graft-azam-baki-145283

FGV suspends group president and CFO 6 June 2017 -- http://www.thestar.com.my/business/business-news/2017/06/06/fgv-zakaria-arshad-suspended/#LmJrOXuiWHmR3lPX.99

Felda Global chairman says parent firm not involved in suspension of CEO Reuters | Published on June 06, 2017 http://english.astroawani.com/business-news/felda-global-chairman-says-parent-firm-not-involved-suspension-ceo-145225

Shahrir hampa 'suara' FELDA dipinggirkan SELASA, 6 JUN 2017 - 9:38AM http://www.bharian.com.my/node/290120?m=1

WHY ISA SAMAD WANTS TO GET RID OF ZAKARIA ARSHAD June 3, 2017 by Raja Petra Kamarudin http://www.malaysia-today.net/why-isa-samad-wants-to-get-rid-of-zakaria-arshad/

Sturgeon-farming project: How Felda 5 beat the system By ALIZA SHAH - January 26, 2017 https://www.nst.com.my/news/2017/01/207460/sturgeon-farming-project-how-felda-5-beat-system

Felda firm's ex-CEO, director charged with CBT 2 Aug 2013 https://www.malaysiakini.com/news/237515

Indonesian Palm Oil's Stranded Assets: 10 Million Football Fields Feb. 15 2017, Gabriel Thoumi, Chain Reaction Research, https://seekingalpha.com/article/4046193-indonesian-palm-oils-stranded-assets-10-million-football-fields - Four detailed case studies presented: Noble Group, Eagle High Plantations, Provident Agro and Tadmax.

Upcoming financial results, deforestation charge weigh on FGV 27 May 2017 Read more at http://www.thestar.com.my/business/business-news/2017/05/27/upcoming-financial-results-deforestation-charge-weigh-on-fgv/#JFPxpj0W4vyU6VSf.99

24 April 2017: Olam Gabon opens 90 tonne palm oil mill at Mouila

Gabon : Olam ouvre sa plus grande usine d’huile de palme sur le continent 13 avril 2017 Par Jeune Afrique avec AFP -- Régulièrement accusé de favoriser la déforestation, le géant singapourien de l'agro-alimentaire Olam a annoncé avoir ouvert le mardi 11 avril au Gabon sa plus grande usine d'huile de palme en Afrique. « D’une superficie de 17 hectares, l’usine permettra de traiter 90 tonnes métriques de régimes de palmier par heure et de produire 138 700 tonnes métriques d’huile de palme par an », détaille un communiqué de la multinationale singapourienne. http://www.jeuneafrique.com/429541/economie/gabon-olam-ouvre-plus-grande-usine-dhuile-de-palme/Ali Bongo a inauguré l’Usine d’huile de palme d’Olam à Mouila http://www.gabonactu.com/ali-bongo-a-inaugure-lusine-dhuile-de-palme-dolam-a-mouila/

Gabon context:

- Olam and Mighty Earth agree to collaborate on Forest Conservation and Sustainable Agriculture in Highly Forested Countries Washington D.C., February 21, 2017 http://www.mightyearth.org/olam-and-mighty-earth-agree-to-collaborate/

- Olam to pause land clearing in Gabon in truce with Mighty Earth February 22, 2017 by ANDREA SOH http://www.businesstimes.com.sg/companies-markets/olam-to-pause-land-clearing-in-gabon-in-truce-with-mighty-earth

- Gabon court upholds Ali Bongo election win 24 September 2016 -- President Bongo won August's election by just 6,000 votes but the opposition says the poll was rigged. Following the court ruling, President Bongo called for a "political dialogue" with the opposition. http://www.bbc.com/news/world-africa-37460453

- Olam Pushes Farms in Africa Oil Producer to Stem Income Fall by Pauline Bax July 6, 2016 https://www.bloomberg.com/news/articles/2016-07-06/gabon-olam-persuade-people-to-farm-as-income-from-oil-dwindles

- Gabon aims to cut yawning poverty gap by ending its dependency on oil -- With a third of its citizens below the poverty line, the African country urgently needs to diversify and is banking on palm oil production to create rural jobs -- Ruth Maclean in Libreville Tuesday 16 August 2016 https://www.theguardian.com/global-development/2016/aug/16/gabon-yawning-poverty-gap-end-dependency-oil

- Gabon Trying to get past oil, One African country’s struggle to diversify Aug 6th 2016 http://www.economist.com/news/middle-east-and-africa/21703289-one-african-countrys-struggle-diversify-trying-get-past-oil

- Gabon looks to Asia to diversify economy By AFP 26 August 2016 -- Since coming to power in 2009 after the death of his long-ruling father Omar Bongo, the president has courted Asian investment to the point that former colonial power investor France has been somewhat sidelined as a favoured investor. http://www.dailymail.co.uk/wires/afp/article-3760427/Gabon-looks-Asia-diversify-economy.html

11 Mar 2017: Indonesia concession maps win for NGO, Wilmar-Amnesty, FGV closes 4 mills and a refinery, illegal plantations

Indonesian Supreme Court orders Jokowi administration to hand over palm oil permit data - 10 March 2017 / Philip Jacobson -- Forest Watch Indonesia has been trying to force the Ministry of Land and Spatial Planning to release in full the maps of oil palm companies' concessions, known as HGUs. The Supreme Court's decision hands the NGO a victory in its freedom of information request, launched in 2015.. Once it receives the hard copies of the documents, FWI will scan and upload them on its website.. Forest Watch Indonesia, an NGO, has won its freedom of information request. https://news.mongabay.com/2017/03/indonesian-supreme-court-orders-jokowi-administration-to-hand-over-palm-oil-permit-data/Palm Oil Giant Denies Covering up Labor Abuses in Indonesia By : Beh Lih Yi | March 08, 2017 -- Amnesty said in a statement on Tuesday that Wilmar — the world's largest palm oil processor — had asked its workers to sign a document to deny the investigation findings during a recent meeting with trade union representatives. Wilmar rejected the claim and said the union representatives had "voluntarily" signed the letters as "a show of support" to the company. http://jakartaglobe.id/news/palm-oil-giant-denies-covering-labor-abuses-indonesia/

FGV earnings down, closing 4 palm oil mills, 2 rubber factories, 1refinery BY AFIQ ISA 1 March 2017 Read more at http://www.thestar.com.my/business/business-news/2017/03/01/fgv-fullyear-earnings-fall-on-rationalisation-oneoffs/#7d95AySK8WmB17Cq.99

National park fights back against illegal plantations by Apriadi Gunawan The Jakarta Post http://www.thejakartapost.com/news/2017/03/11/national-park-fights-back-against-illegal-plantations.html

10 Feb 2017: Indonesia wins cases against companies but none have paid fines or compensation, FGV, Sime Darby and other news

FGV: KPF share sale a non-issue BY AFIQ ISA 9 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/09/fgv-kpf-share-sale-a-nonissue/#S5K44jKsR9ZIE4Hd.99

Malaysia's Sime Darby to Spin off Plantation, Property Businesses By : Emily Chow | on 9:00 AM January 27, 2017 http://jakartaglobe.id/international/malaysias-sime-darby-spin-off-plantation-property-businesses/

CB Industrial group files RM8.4mil claim against TDM subsidiary BY M. HAFIDZ MAHPAR 9 February 2017 Read more at http://www.thestar.com.my/business/business-news/2017/02/09/cb-industrial-group-files-rm8pt4mil-claim-against-tdm-subsidiary/#xLR4OJH8e5fdkDHS.99

Indonesia - Government wins in forest fire case by Hans Nicholas Jong The Jakarta Post Jakarta | Thu, February 9, 2017 -- In the fight against deforestation and forest fires, the Environment and Forestry Ministry is on a winning streak, with the courts ruling in favor of the government in cases against companies. Still, the enforcing of penalties remains weak.... In its latest victory, the South Jakarta District Court found palm oil company PT Waringin Agro Jaya (WAJ) guilty on Tuesday of illegally starting a forest fire to clear land in Ogan Komering Ilir, South Sumatra. The court ordered the company to pay Rp 466.5 billion (US$35 million), Rp 173.5 billion of which will serve as compensation for the burning of 1,626 hectares of land in its land concession and another Rp 293 billion to cover the rehabilitation cost for the burned land. The fine was lower than the ministry’s demand of Rp 754 billion.... However, none of the companies have paid the fines or compensation. The ministry’s law enforcement director general, Rasio Ridho Sani, acknowledged that it was a challenge for the ministry to enforce verdicts. It takes time for verdicts to be enforced because the ministry has to wait for the official record of the verdict to be available, which can take months to more than a year. Moreover, there is no standard operating procedure for the enforcement of forest-related rulings. The ministry is pushing for the Supreme Court to issue a regulation on its judges to help with the enforcement of penalties....http://www.thejakartapost.com/news/2017/02/09/government-wins-in-forest-fire-case.html

4 Jan 2017, 31 Dec 2016: Felda-Eagle High Plantations deal in the news

Editor's note: 300,000ha of planned new plantings is reported. By regulation planting should start within 3 years as land bank only can be kept for 3 years, and after 3 years it will be given back to the government. This rule is regarded as better implemented than before, but it may not be as strict as we think, so long as there is progress to show.

While Eagle High's planted area is 125,000ha, its total land bank is more than 400,000ha. Even though the US$505.4 million price takes into account only the 125,000ha that are already planted, the green light has already been given for the planting of some 300,000ha.... http://www.theedgemarkets.com/my; mentions PT EAGLE HIGH PLANTATIONS TBK https://chainreactionresearch.com/reports/2016-sustainability-benchmark-indonesian-palm-oil-growers/pt-eagle-high-plantations-tbk-bwptij/

EPF not to be blamed for leaving FGV BY M. SHANMUGAM 3 January 2017 http://www.thestar.com.my/business/business-news/2017/01/03/epf-not-to-be-blamed-for-leaving-fgv/

FAQ: The Felda - Eagle High Plantation deal 25 DECEMBER 2016 Read More : http://www.nst.com.my/news/2016/12/199364/faq-felda-eagle-high-plantation-deal

Strategi Besar FGV Pasca Pembelian Saham 37% Eagle High Plantation 26 Dec 2016 by Qayuum Amri -- Post this acquisition, FGV will have access to manage 287 thousand hectares of land ...https://www.sawitindonesia.com/rubrikasi-majalah/berita-terbaru/strategi-besar-fgv-pasca-pembelian-saham-37-eagle-high-plantation

Felda says 'no' financial burden from US$505m Eagle High stake buy By Chong Jin Hun / theedgemarkets.com | December 31, 2016 http://www.theedgemarkets.com/en/article/felda-says-no-financial-burden-us505m-eagle-high-stake-buy?type=Corporate

Felda secures Malaysian govt financing for Eagle High stake purchase Dec 28, 2016 http://www.reuters.com/article/malaysia-felda-eagle-high-idUSL4N1EO18M

FGV continues dip after Felda's US$505.4m Eagle High buy By Sangeetha Amarthalingam / theedgemarkets.com | December 29, 2016 http://www.theedgemarkets.com/my/article/fgv-continues-dip-after-feldas-us5054m-eagle-high-buy On Dec 23, FIC Properties Sdn Bhd (FICP) inked a sale and purchase agreement with PT Rajawali Corp to acquire a 37% stake in Indonesia-listed Eagle High for US$505.4 million (RM2.26 billion).... Initially, FGV was to purchase the stake but talks ended following the advice by its bankers, JPMorgan and Bank of America, to opt out of the deal as the then US$680 million price tag was seen as too high for the 37% Eagle High stake.... The latest acquisition by FICP has stirred analysts and critics who claim that the deal was too expensive and would not derive synergy as Felda does not have a controlling stake in Eagle High.

Felda secures Malaysian govt financing for Eagle High stake purchase By Reuters / Reuters | December 29, 2016 http://www.theedgemarkets.com/my/article/felda-secures-malaysian-govt-financing-eagle-high-stake-purchase

No synergy seen in Felda’s Eagle High buy By Sangeetha Amarthalingam & Chester Tay / The Edge Financial Daily | December 29, 2016 http://www.theedgemarkets.com/my/article/no-synergy-seen-felda%E2%80%99s-eagle-high-buy

Palm oil deal embroiled in Malaysian politics DECEMBER 30, 2016 by: Jeevan Vasagar https://www.ft.com/content/44e04f0a-ccd6-11e6-864f-20dcb35cede2

Felda-Eagle High deal slammed for profiting Indonesia's Rajawali 29 Dec 2016 -- PAS deputy president Tuan Ibrahim Tuan Man pointed out how Indonesian billionaire Peter Sondakh, who owns Rajawali Group, had purchased shares at EHP for 400 rupiah per share. It was estimated that Rajawali Group had spent US$570 million to acquire a 68.6 percent stake in EHP. Read more: https://www.malaysiakini.com/news/367523#ixzz4UFnsoVEB

Rafizi poses questions to PM on Felda-Eagle High Plantations deal Read more: https://www.malaysiakini.com/news/367357#ixzz4UFnZvyRw

News update for 6 Sep to come 30 Dec customised.

5 Sep 2016: PTPN III prepares strategies, Wilmar helps smallholders, Malaysia peatland policy

PTPN III prepares strategies to reverse poor situation Jakarta | Thu, August 25 2016 -- It became a holding company in October 2014 and now manages 13 state-owned plantation firms.

In the first six months of 2016, it already reported a net loss of Rp 823.43 billion (US$62.14 million) that was deeper than the Rp 529.95 billion net loss it posted last year.

“Our losses were mostly caused by sluggish productivity in our oil palm and rubber plantations,” PTPN III president director Elia Massa Manik said in a briefing in Jakarta on Tuesday.

Elia attributed the sluggish productivity to mature oil palm trees, low commodity prices and mismanagement, especially on rubber plantations.

PTPN III’s plantations are dominated by oil palm trees that cover 57.5 percent of the area, followed by rubber trees that cover 19.53 percent and other plants that take up the remaining parts.

http://www.thejakartapost.com/news/2016/08/25/ptpn-iii-prepares-strategies-reverse-poor-situation.html

Wilmar helps smallholders gain sustainability certificates Jakarta | Wed, August 24 2016 http://www.thejakartapost.com/news/2016/08/24/wilmar-helps-smallholders-gain-sustainability-certificates.html

Malaysia challenges the world over palm oil on peatland by Bambang Nurbianto, The Jakarta Post in Kuching, Serawak, Malaysia | Wed, August 24 2016 -- http://www.thejakartapost.com/news/2016/08/24/malaysia-challenges-the-world-over-palm-oil-on-peatland.html

News update for 29 Jul to 4 Sep customised.

29 July 2016: Some sugar growers reject Wilmar, Sime Darby mill cleared, NGO calls on Liberia to prevent the export of tropical timber from plantation concessions, Felda investment - Rajawali deal

Australia - Majority of Burdekin growers reject Wilmar offer 28 July 2016 -- Burdekin growers have put forward a united front, with majority in the region choosing to reject Wilmar's Cane Supply Agreements (CSA) for 2017, according to local press reports. It has been an uphill battle between growers and millers since Wilmar https://www.agra-net.com/agra/international-sugar-and-sweetener-report/sugar-news/cane-sugar/australia---majority-of-burdekin-growers-reject-wilmar-offer--1.htm

Australia - Sugar industry re-regulation slammed by Productivity Commission 25 July 2016 -- A draft report on the way forward for farm businesses burdened by regulation has reignited a bitter feud in Australia's sugar industry by recommending new sugar marketing laws be scrapped, according to the Australian Broadcasting Corp. https://www.agra-net.com/agra/international-sugar-and-sweetener-report/sugar-news/cane-sugar/australia---sugar-industry-re-regulation-slammed-by-productivity-commission--1.htm

Adani Wilmar to diversify into value-added food business - Adani Wilmar plans to tap overseas markets, including China and Malaysia, with its value-added oil and food products Jul 29 2016 http://www.livemint.com/Companies/MGsBaBBUYBpimJDyoskAqK/Adani-Wilmar-to-diversify-into-valueadded-food-business.html

Sime Darby’s Ulu Remis Palm Oil Mill Cleared for Operations -- Kuala Lumpur, 27 July 2016 - Sime Darby Plantation yesterday received a letter from the Department of Environment, Johor, reinstating the license to operate its Ulu Remis Palm Oil Mill in Johor. http://www.simedarby.com/media/press-release/sime-darby-s-ulu-remis-palm-oil-mill-cleared-for-operations

Take action against errant industries BY DEBBIE INJAN ANAK ANDREW JUMAT - 23 JULY 2016 -- According to the Department of Environment, the total water pollution sources (both point sources and non-point sources) in 2006 is 19.7 per cent in Johor and this region has a high oil palm density. Recently, there were water disruptions in Johor due to Sungai Johor being polluted with high ammonia content. This was detected on July 12 by the state authorities. It rendered the water unfit for human consumption. The pollution forced the temporary shutdown of three water treatment plants: Sungai Johor, Semanggar and Tai Hong. The temporary shutdown of these plants affected 120,000 accounts in the southern part of Johor, not to mention the impact on the river ecosystem....This is the second case after an illegal waste-processing factory was charged for dumping waste into the river last year....Since the 1970s, Malaysia has regulated industrial effluents, including those from the palm oil industry. The Environmental Act 1974 prohibits the discharging of effluents into the river to protect our water sources. Read More : http://www.nst.com.my/news/2016/07/160141/take-action-against-errant-industries

“Liberia’s Rainforests In Danger” 07/27/2016 By William Q. Harmon -- SDI says the country’s forests are under renewed threats from what it termed as Conversion Timber/Logging, which the government is on the verge of introducing – and has the potential to destroy the country’s remaining rain forests....At a ceremony over the weekend where the SDI presented a petition to government, SDI disclosed that the Forestry Development Authority (FDA) has developed regulations that would enable large-scale timber extraction in agricultural concession areas for export. SDI believes this will further exacerbate the threats from the oil palm sector...At present, commercial logging and timber export are banned. Were government to permit the sale of timber from the legal clearing of forests for oil palm concessions, this would simplify the laundering of illegal timber and drastically increase the pressure on the country’s forests.... However, SDI has been joined by 50 international holders of the prestigious Goldman Environmental Prize calling on the government to prevent the export of tropical timber from plantation concessions.... http://www.liberianobserver.com/news/%E2%80%9Cliberia%E2%80%99s-rainforests-danger%E2%80%9D

Felda investment unit, Rajawali likely to ink stake deal soon BY AFIQ ISAandIZWAN IDRIS 28 July 2016 -- PETALING JAYA: An investment unit of the Federal Land Development Authority (Felda) may sign an agreement for the acquisition of a significant stake in Indonesian planter Eagle High Plantations Tbk. According to sources, representatives from the Rajawali Group and Felda may be meeting in Jakarta next week for a signing ceremony to conclude the deal, which has been over a year in the making and has undergone several iterations. ...http://www.thestar.com.my/business/business-news/2016/07/28/eagle-high-deal-at-final-stage-of-conclusion/

Stock With Momentum: Felda Global Ventures Holdings By Asia Analytica / The Edge Financial Daily | July 26, 2016 http://www.theedgemarkets.com/my/article/stock-momentum-felda-global-ventures-holdings

PM: Children of Felda settlers in Klang Valley proof of social mobility BY KAMLES KUMAR http://www.themalaymailonline.com/malaysia/article/pm-children-of-felda-settlers-in-klang-valley-proof-of-social-mobility#sthash.zURXzuo1.dpuf

Affin Hwang lowers IOI Corp earnings forecast 22 July 2016 http://www.thestar.com.my/business/business-news/2016/07/22/affin-hwang-lowers-ioi-corp-earnings-forecast/

RAM Ratings reaffirms Batu Kawan RM500m debt notes 25 July 2016 http://www.thestar.com.my/business/business-news/2016/07/25/ram-ratings-reaffirms-batu-kawan-rm500m-debt-notes/

US investors ploughing billions into palm oil, claims report - Friends of the Earth warns investors they could be unknowingly contributing to deforestation and land grabs, and calls on them to show leadership Oliver Milman 26 July 2016 https://www.theguardian.com/sustainable-business/2016/jul/26/palm-oil-us-investors-deforestation-land-grabs-pension-funds-banks-forest-fires-climate-change

Failure of Indonesia’s palm oil commitment ‘not bad news’ [commentary] 27 July 2016 / Commentary by Scott Poynton Scott Poynton is the founder of The Forest Trust (TFT), an international non-profit that works with corporations to address environmental challenges. In this editorial, Poynton says there is “no time for NGO Handwringing: IPOP was a distraction. Its demise is not bad news”. The views expressed in this commentary are his own. https://news.mongabay.com/2016/07/failure-of-indonesias-ipop-not-bad-news-commentary/

26 July 2016: Oxfam - 10 Companies Own All The World’s Brands, COFCO-Chinatex Merger, South Africa collusion case and more

This Infographic Shows How Only 10 Companies Own All The World’s Brands by Kate Ryan -- Credit: Oxfam International. Just when you think there’s no end to the diversity of junk food lining supermarket aisles, an insanely detailed infographic comes along to set us all straight. Out of the hundreds of products at our disposal, only ten major corporations manufacture the bulk of what we toss in our shopping carts. So whether you’re looking to stock up on anything from orange soda to latte-flavored potato chips, Mondelez, Kraft, Coca-Cola, Nestlé, PepsiCo, P&G, Johnson & Johnson, Mars, Danone, General Mills, Kellogg's, and Unilever own just about everything you could hope to buy. It seems that six degrees of separation theory has been proven after all, if only because we all drink Diet Coke every now and then. In order to visually elucidate that point, Oxfam International created a comprehensive infographic that reveals the extensive reach of the “Big 10” food and beverage companies. Unlikely ties between brands we largely don’t associate with one another show how easy it is to be misinformed about the American food system. For example, PepsiCo produces Quaker granola bars, and Nestlé makes Kit Kat bars but also frozen California Pizza Kitchen pies. To the surprise of many, Pineapple Fanta isn’t sourced straight from the mythical Fanta Islands, but canned right alongside Barq’s root beer at the Coca-Cola factory....

https://www.good.is/articles/

COFCO-Chinatex Merger to create grain trading force China Daily, July 16, 2016 -- The State-owned Assets Supervision and Administration Commission on Friday announced the merger of China National Cereals, Oils and Foodstuffs Corp with Chinatex Corp, in the process of creating a bigger rival to compete with the so-called ABCD companies....The term ABCD refers to the companies that dominate global grain trading, serving as middlemen between farmers and buyers. The groups are ADM Co, Bunge Ltd and Cargill Inc from the United States, and the Netherlands-based Louis Dreyfus SAS. Chinatex, one of the nation's main textile and grains trading groups, will become a subsidiary of COFCO, the country's biggest food trader after the merger, the SASAC said on its website, indicating that the central government would push further ahead with its efforts to restructure State-owned enterprises this year..... http://www.china.org.cn/

Weak output, heavy levies to slam Bumitama Agri’s Q2 profits Staff Reporter, Singapore Published: 22 Jul 16 - See more at: http://sbr.com.sg/

INVESTOR KORSEL BAKAL BANGUN PABRIK BIODIESEL DI KALBAR Berita Utama | 25 July 2016 http://www.infosawit.com/news/4995/investor-korsel-bakal-bangun-pabrik-biodiesel-di-kalbar

An Investor’s Look At The Financial Performance Of Wilmar International Limited And First Resources Ltd By Lawrence Nga - July 21, 2016 https://www.fool.sg/2016/07/21/an-investors-look-at-the-financial-performance-of-wilmar-international-limited-and-first-resources-ltd/

What Investors Should Know About Malaysian Palm Oil Company: Kuala Lumpur Kepong Berhad By Lawrence Nga - July 20, 2016 https://www.fool.sg/2016/07/20/what-investors-should-know-about-malaysian-palm-oil-company-kuala-lumpur-kepong-berhad/

Is Wilmar’s second-quarter loss a harbinger for the sector? Singapore-based agricultural trader cites flooding in Argentina and volatility in soyabean prices by Emiko Terazono https://next.ft.com/content/911250ea-4f53-11e6-88c5-db83e98a590a

PPB Group falls after Wilmar profit warning 20 July 2016 http://www.thestar.com.my/business/business-news/2016/07/20/ppb-group-falls-after-wilmar-profit-warning/

Soy, sugar rallies wrong-foot Wilmar, which plunges into rare loss 19th Jul 2016, by Mike Verdin http://www.agrimoney.com/news/soybean-sugar-rallies-wrong-foot-wilmar-which-plunges-into-rare-loss--9756.html

Wilmar shares recover, a little, after worst fall since 2012 20th Jul 2016, by Agrimoney.com http://www.agrimoney.com/news/wilmar-shares-recover-a-little-after-worst-fall-since-2012--9764.html

Sime Darby Hudson Knight signs consent agreement over collusive conduct BY MARK ALLIX, 20 JULY 2016 http://www.bdlive.co.za/business/retail/2016/07/20/sime-darby-hudson-knight-signs-consent-agreement-over-collusive-conduct

Sime Darby and Unilever operated a cartel in South Africa by Will Green news editor of Supply Management http://www.cips.org/en-SG/supply-management/news/2016/july/sime-darby-and-unilever-operated-a-cartel-in-south-africa/?src=ilaw

Brexit impact on Sime Darby’s Battersea development limited By Affin Hwang Research / The Edge Financial Daily | July 18, 2016 http://www.theedgemarkets.com/my/article/brexit-impact-sime-darby%E2%80%99s-battersea-development-limited

Malaysian Government Studying Sri Lanka, Sime Darby's Plantation Worker Requests From R. Ravichandran http://www.bernama.com.my/bernama/v8/ge/newsgeneral.php?id=1265252

Govt to study request for Lankan workers BY ZULKIFLI ABDUL RAHMAN IN COLOMBO 22 July 2016 http://www.thestar.com.my/news/nation/2016/07/22/tapping-into-human-capital-govt-to-study-request-for-lankan-workers/

Cargill latest to drop IOI Corp as palm oil supplier after RSPO suspension By Supriya Surendran / theedgemarkets.com | July 19, 2016 http://www.theedgemarkets.com/my/article/cargill-latest-drop-ioi-corp-palm-oil-supplier-after-rspo-suspension

Cargill suspends new purchase agreements with Malaysian palm oil giant IOI 18 July 2016 / Mongabay.com - Under pressure from civil society, IOI’s customers attempt to clean up their palm oil supply chains. https://news.mongabay.com/2016/07/cargill-suspends-new-purchase-agreements-with-malaysian-palm-oil-giant-ioi/

Affin Hwang lowers IOI Corp earnings forecast 22 July 2016 - o recap, IOI submitted a status update of its quarterly progress report on June 27 and is now awaiting an official reply from the Roundtable on Sustainable Palm Oil (RSPO) Complaint Panel on its application to lift the certification suspension. “The decline in market capitalisation since March seems disproportionate to the potential financial impact. A positive outcome on its application hence is expected to result in a share price rebound, in our view,” it said. http://www.thestar.com.my/business/business-news/2016/07/22/affin-hwang-lowers-ioi-corp-earnings-forecast/

Worst may be over for Sime Darby’s, but upturn yet to be seen July 16, 2016 -- As for Sime’s plantations business, it noted that Sime is leading in sustainability compliance and it believed risk of non-compliance is low. “As at end-2015, 100 per cent of its Malaysian upstream and downstream business units, and 96 per cent of its Indonesian upstream and 77 per cent of downstream business units are RSPO-certified. “All of NBPOL’s upstream operations (including all smallholders) and its downstream unit In Liverpool are also RSPO-certified. SIME now supplies approximately 20 per cent of the global CSPO market. “In plantation development, the group complies strictly with RSPO Principles & Criteria (RSPO P&C); Free, Prior and Informed Consent (FPIC) processes; and Social & Environmental Impact Assessments (SEIA) standards. Development in High Conservation Value (HCV) areas is avoided and a Zero Burning Policy has been implemented since 1985,” it explained. http://www.theborneopost.com/2016/07/16/worst-may-be-over-for-sime-darbys-but-upturn-yet-to-be-seen/

LIBERIA: Sime Darby’s Response to The Inquirer’s Article July 26, 2016 Cholo Brooks -- Monrovia, 26 July 2016 – In reference to the article published in The Inquirer on July 25th headlined “Sime Darby Given 14 days Ultimatum” , Sime Darby Plantation Liberia (SDPL) would like to inform all our stakeholders who have been assisting us and the communities in this matter , that SDPL has received a letter from the communities that is in substance the source of the story published in The Inquirer . The letter was signed by Eshmeal H. Pusah, Sr . and Jefferson V . Paasewe, claiming to be, respectively, new Secretary and new Chairman of the Project Affected Community . The letter was also signed by 65 residents of the 15 townships which are part of the 17 project affected communities (P AC). SDPL takes seriously the concerns raised by the community , and that is why SDPL established the independent multi-stakeholder crop compensation investigation on process that would review the evidence and make recommendations on how best to resolve the issue. Meanwhile, SDPL seeks to set the record straight.....http://gnnliberia.com/2016/07/26/liberia-sime-darbys-response-inquirers-article/

IMOIIMAX tanker Stena Imagination is delivered in International Shipping News 16/07/2016 -- The MR tanker Stena Imagination has been delivered from the Chinese shipyard GSI (Guangzhou Shipbuilding International). The vessel is jointly owned on a 50-50 basis by Stena Bulk and Indonesian Golden Agri Resources (GAR) and is the seventh of a total of 13 IMOIIMAX tankers ordered by Stena Bulk. She will be operated by Stena Weco and sail in the company’s global logistics system, which currently employs about 60 vessels. http://www.hellenicshippingnews.com/imoiimax-tanker-stena-imagination-is-delivered/

GAR Podcast: The challenges of achieving traceability, access to markets and sustainability targets for smallholders farmers -- Ian Welsh from Innovation Forum talks to Anita Neville, Vice President, Corporate Communications and External Affairs at GAR about the challenges of achieving traceability, access to markets and sustainability targets for smallholders farmers. Listen to the podcast here. http://www.goldenagri.com.sg/blogs-77

Eye on stock; Felda Global Ventures BY K.M. LEE 16 July 2016 http://www.thestar.com.my/business/business-news/2016/07/16/eye-on-stock-felda-global-ventures/

Renewed buying interest emerged in Felda Global, says AllianceDBS Research By theedgemarkets.com / theedgemarkets.com | July 18, 2016 http://www.theedgemarkets.com/my/article/renewed-buying-interest-emerged-felda-global-says-alliancedbs-research

Agenda to develop Felda, nation remains as govt’s top priority, Najib says - See more at: http://www.themalaymailonline.com/malaysia/article/agenda-to-develop-felda-nation-remains-as-govts-top-priority-says-najib#sthash.UBEqOBQT.dpuf

19 July 2016: United Plantations labour contractor issue in the news

Worker attempts suicide, PSM and firm resolve 'misunderstanding' 14 Jul 2016 -- A worker tried to hang himself last month after claiming that a Perak plantation firm he worked for was withholding his wages. The worker was rushed to hospital and a police report was lodged by PSM against United Plantations (UP) on Monday. However, after a meeting with UP in Teluk Intan on Wednesday, PSM deputy chairperson M Sarasvathy said there was a "misunderstanding"....https://www.malaysiakini.com/news/348505

PSM, Plantation Firm Resolve 'Misunderstanding' Over

Worker's Unpaid Salary Claim by Ivy Chang | 15 July 2016 -- PETALING JAYA:

Parti Sosialis Malaysia and United Plantations have resolved a misunderstanding

over a worker who tried to hang himself last month after reportedly claiming

that the plantation firm he worked for was withholding his wages. After a

meeting with UP in Teluk Intan on Wednesday, PSM deputy chairperson M

Sarasvathy told news portal Malaysiakini there was a

"misunderstanding". "The meeting was attended by top level

management of UP who explained to us that there has been a misunderstanding, as

the worker’s wages were fully paid up.... "However, the management agreed

to resolve the complaints and claims raised on behalf of the worker in relation

to his employment under a

contractor." The worker, B Kannan, an Indian national was rushed to

hospital after the suicide bid and PSM had lodged a police report against the

plantation firm on Monday. The worker was also "overjoyed" with the

outcome, she said.... UP head manager C Mathew said while the suicide attempt

was "unfortunate",

Kannan had problems with absenteeism and this disqualified him for gratuitous

payment. "UP is known to respect and take care of its workers which it

will continue to do as it has done in the past. "However, we can’t reward

and pay workers who are absent and unproductive... that would be unfair

to the many hardworking and productive workers in our company." He said

the company was thankful Kannan survived the suicide attempt and would ensure

his safe return to India. He added that the company would give him ex-gratia

payment for his emotional distress.... https://asklegal.my/p/psm-plantation-firm-resolve-misunderstanding-over-worker-s-unpaid-salary-claim

17 July 2016: Indofood, Golden Agri Resources to become world leaders, GVL says no timber sales from concession area