CIMB recently issued a report on its survey of 3,000 or so of its staff on their cooking oil preferences. The main finding was on health nutrition perception. Do check it out: "Plantations (N) - Opting for healthier cooking oils" noting that "We were slightly surprised that only 43% of respondents in our recent survey picked palm oil as their preferred cooking oil. This could be due to the rising affluence of Malaysian consumers as well as a lack of awareness of the health benefits of palm oil as cooking oil producers may have shifted their marketing activities to other edible oils over the years given that palm-olein-based cooking oil is regulated. The survey reveals that more work may be needed to educate consumers of the health benefits of palm oil. Maintain Neutral on the sector with First Resources as our top pick."

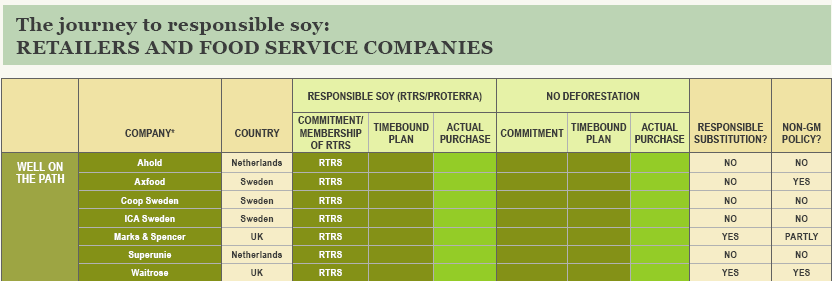

I've downloaded and will be reading with interest WWF's "Soy Report Card - Assessing the use of responsible soy for animal feed in Europe," The broad finding on 88 European retailers, food service companies, CGMs and dairy, meat, egg and feed companies sourcing of soy for animal feed or animal products: "The picture is disappointing. Some frontrunner companies have made strong

commitments to stop sourcing irresponsible soy from recently cleared forests, savannahs and grasslands. They have also started buying “better soy” from producers who adhere to robust responsible production guidelines.... The majority, however, are lagging behind in commitments – and even more in concrete actions such as buying responsible soy. This leaves producers with little incentive to certify their soy as responsible and risks the integrity of some of the world’s most valuable ecosystems, like the Amazon, Cerrado and Chaco."

source: WWF Soy Report Card 2014

WWF says: "It’s not only about forests — grasslands and savannahs can also be negatively impacted by irresponsible soy production." It talks about "responsible substitution" or the substitution of imported soy to "build high quality European protein supplies customized for the requirements of the European market and, in some cases, to address the demand from some European consumers for GM-free soybeans and soy protein feed. Examples of such initiatives include Danube Soya...."