Mapping the Natural Rubber Value Chain in Malaysia

Happy New Year, everyone! It’s been a tumultuous end to 2021—the Philippines was ravaged by Typhoon Odette, Malaysia faced one of its worst floods in decades, several countries around the world were reporting and/or expecting a surge in Omicron infections.

The floods has triggered yet another wave of anger against the government, with frustrated Malaysians taking to social media to criticise officials for their incredibly slow response. Citizens and migrants are forced to help each another once again, this time under the #BanjirDarurat (Flood Emergency) campaign. Questions are also heating up on deforestation and the source of log jams in rural zones. As usual, we have the relevant social media data which we will explore in our next post under the Data and Analysis page.

For this post, a brief moment of happy news for us: in mid-December 2021, WWF released two reports exploring the sustainability issues surrounding the Malaysian natural rubber industry, both of which Segi Enam authored. What we found was that while the rubber supply chain is generally straightforward, the lack of transparency, traceability, and publicly available data makes it a difficult industry to evaluate when it comes to sustainability standards. Much of the root of the problem lies within the production system—for instance, smallholders dominate in this area and are typically not afforded the incentives to adopt more sustainable practices.

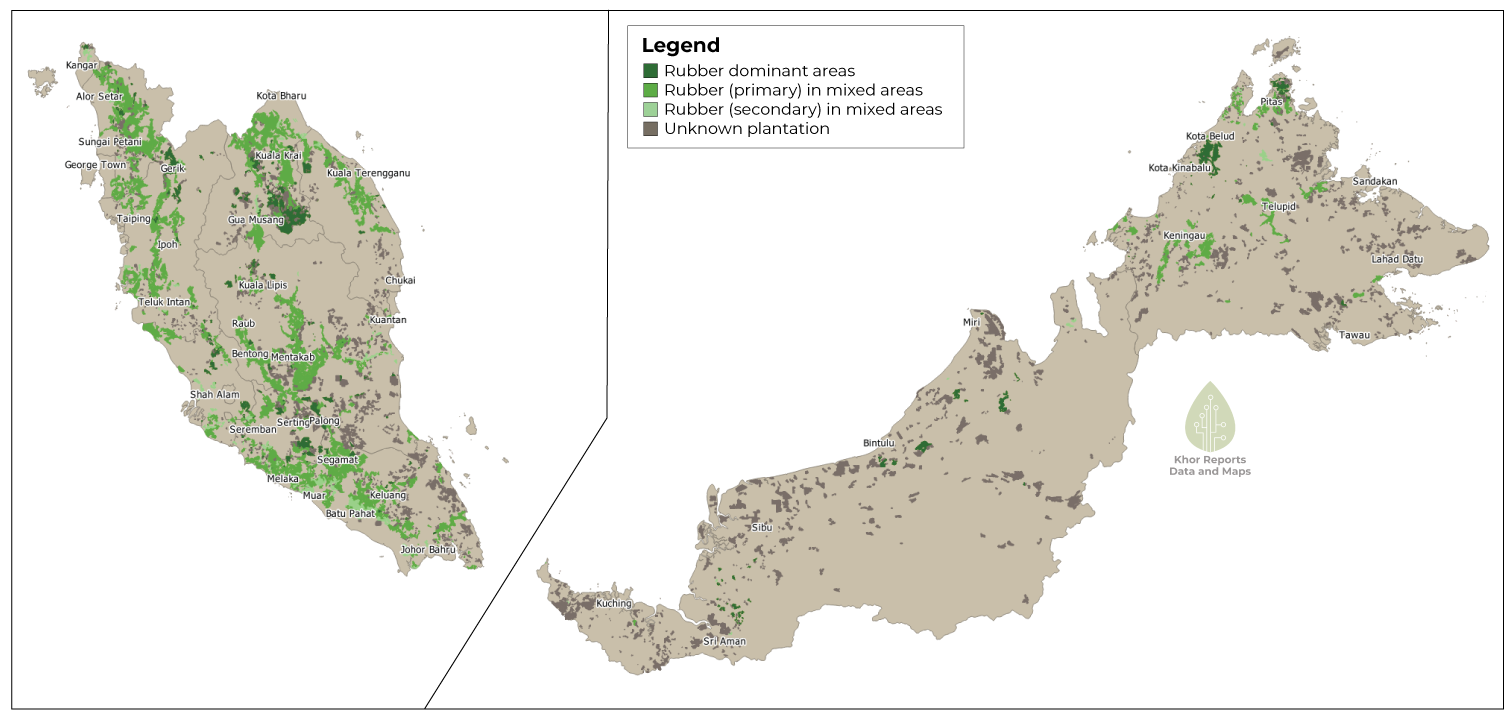

Segi Enam (WWF; 2021): Indicative map of rubber plantations in Malaysia based on the 2013-2014 dataset and maps retrieved from the Global Forest Watch (GFW) platform. Rubber dominant zones (dark green and mid-green) include: (1) Gua Musang, Kelantan; (2) near the Gerik, Perak-Southern Thai border; (3) Serting and Palong, Negeri Sembilan; (4) Lipis and Raub, Pahang; and (5) FELCRA/RISDA projects in Sarawak and estates in Sabah.

Read the full report here: Mapping the Natural Rubber Value Chain in Malaysia.

For the second report focusing specifically on the rubberwood sector: Addendum Report on Rubberwood