21 September 2014: Lots of talk about Felda Global / FGV share price among KL share market observers. It recently fell to a low of RM3.46/share. Notably below even the most pessimistic view (Macquarie - see below) at the time of its IPO in mid 2012. The 52-week share price trading range: 3.460 - 4.700.

source: Bloomberg.com, 19 September 2014

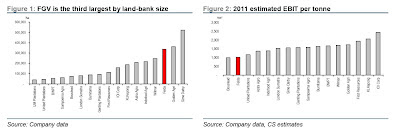

13 July 2012: Credit Suisse issues report on Felda Global, 12 July 2012: "We initiate coverage on Felda Global Ventures (FGV) with an UNDERPERFORM rating and a target price of RM4.90, a potential downside risk of 11%. There are far better choices—younger age profile with more attractive valuations—in the region. We prefer Genting Plantations and Sime Darby in Malaysia, London Sumatra and Salim Ivomas in Indonesia.... Positives: large, leveraged to palm oil prices, fast-tracked to the indices, net cash position, clear dividend policy and a turnaround plan for downstream... Negatives: Old with falling yields, low profitability, minimal organic growth, potentially less transparency, 1QFY12 results have halved... Expensive and fully valued at CY12 and CY13 P/Es of 16.9x and 17.4x respectively..."

Khor Reports Comment: This is the second "underperform" rated report on Felda Global by an investment broker that we have seen. Another report, issued by Macquarie Equities Research on 29 June 2012, gives a price target of RM3.85.