5 Jan 2017: Reading about the Trump Trade Doctrine in Talking Trade blog by Dr Deborah Elms

How Much Change Is Coming From Washington On Trade? January 5, 2017 -- While we don’t want to spend too much time at Talking Trade watching unfolding events in Washington DC, the changes happening now are likely to significantly affect trade across Asia. This is not a typical American administration. President-elect Donald Trump has now named enough of his staff to show that his comments on the campaign trail and his various tweets and actions since his election were not simply pandering to the electorate. He intends to handle trade policy quite differently.... http://www.asiantradecentre.org/talkingtrade//how-much-change-is-coming-from-washington-on-trade

Reprint: Trump's Trade Policy Revisited December 2, 2016 -- The Trump Trade Doctrine requires renegotiating all bad trade deals to ensure that all agreements increase the GDP growth rate, decrease the trade deficit, and strengthen the US manufacturing base. ...The “obvious Trump negotiating strength” will rebalance trade with the six countries that hold half the US deficit: Canada, China, Germany, Japan, Mexico and South Korea....The Koreans will just recognize that the current KORUS arrangement is not working and will “simply seek a far more equitable deal.” Germany and Japan will negotiate mostly for US energy (with the added bonus of creating additional US jobs).... China, Navarro and Ross admit, is a tougher nut to crack. But soybeans, petroleum, motorcycles and raisins, plus a few other goodies should surely be sufficient as carrots when matched with “the strength and resoluteness of Trump.” ...And thus, in less than two dozen pages, the Trump economic plan shows exactly how America’s real GDP growth rate will be increased with millions of new jobs created and generate trillions of new dollars in additional income and tax revenues.... Getting from here to there may, as it happens, fundamentally overturn decades of US trade policy as practiced by Republican and Democratic administrations. But the results—Trump would surely say—will be SOOO worth it.... ***This Talking Trade blog post was written by Dr. Deborah Elms, Executive Director, Asian Trade Centre, Singapore***

http://www.asiantradecentre.org/talkingtrade//reprint-trumps-trade-policy-revisited

12 November 2016: US biofuel risk, Donald Trump 100 days plan video, Malaysia ringgit more exposed, Europe food industry reactions

Editor's note: US support for imported biofuels is obviously in some doubt - for blenders credit to shift to producer credit. RIN's immediately dropped.

Donald Trump outlines policy plan for first 100 days By Tom LoBianco, CNN November 22, 2016 http://edition.cnn.com/2016/11/21/politics/donald-trump-outlines-policy-plan-for-first-100-days/index.html

Donald Trump's first 100 days: A breakdown of his plan By James Masters, CNN November 22, 2016 http://edition.cnn.com/2016/11/22/politics/trump-first-100-days-plan/index.html

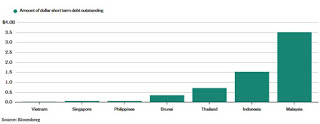

Malaysia caught in currency ripples - Bloomberg, By: Christopher Langner (Nov 21) -- A drop in hedging and refinancing activities would be bad news for banks. Ironically, Malaysian financial institutions could be the worst affected. They're the biggest issuers of short-term dollar debt, with more than US$3.5 billion ($5 billion) of bonds due in less than a year outstanding.... Malaysian banks are the most dependent on short-term markets for dollar funding in Southeast Asia.

http://smr.theedgemarkets.com/article/malaysia-caught-currency-ripples

Your thoughts on Trump's triumph: From 'authoritarian tactics' to 'a thriving business environment'

By Niamh Michail+, 15-Nov-2016

Brash, billionaire businessman Donald Trump is America's president elect. While some FoodNavigator readers foresee "authoritarian tactics" from "an unpredictable man" others are looking forward to "a thriving business environment" for the US and Europe.

http://www.foodnavigator.com/Trends/Food-prices/Your-thoughts-on-Trump-s-triumph-From-authoritarian-tactics-to-a-thriving-business-environment

By Niamh Michail+, 15-Nov-2016

Brash, billionaire businessman Donald Trump is America's president elect. While some FoodNavigator readers foresee "authoritarian tactics" from "an unpredictable man" others are looking forward to "a thriving business environment" for the US and Europe.

http://www.foodnavigator.com/Trends/Food-prices/Your-thoughts-on-Trump-s-triumph-From-authoritarian-tactics-to-a-thriving-business-environment

17 November: Foreign banks shaken by Malaysia's move to halt currency slide, Malaysia's Running Out of Trump Cards

Foreign banks shaken by Malaysia's move to halt currency slide By Saikat Chatterjee and Praveen Menon | HONG KONG/KUALA LUMPUR -- "There's a massive back and forth going on between banks and Bank Negara Malaysia (BNM) now," said a banker at a foreign bank in Malaysia that deals in foreign currency transactions. "This is a type of indirect capital control ... I see a flood of people exiting Malaysia." ... "We have been told that we cannot repatriate our money and our investments stay in Malaysia if we don't sign," he said. The bankers asked for anonymity, due to the sensitivity of the subject. Foreign holdings account for 40% of the total outstanding bond market in Malaysia, one of the largest foreign ownerships in Asia.... Foreign investors pulled 8.4 billion ringgit out of government bonds in September, the largest outflow since August last year, when Malaysia's markets tumbled on a political crisis swirling around Prime Minister Najib Razak and corruption allegations involving indebted state fund 1Malaysia Development Berhad (1MDB).... In October, however, there were inflows of 2.39 billion ringgit into government bonds, and foreign reserves rose to US$97.8 billion by the end of the month, up from US$97.7 billion at the end of September. The reserves were enough to finance 8.4 months of retained imports.... http://www.reuters.com/article/us-malaysia-fx-controls-idUSKBN13C0M5

Malaysia's Running Out of Trump Cards By Andy Mukherjee -- Amid a deepening emerging-market rout, three of Donald Trump's seven promises to American workers are making Asia particularly nervous.... Although no Asian nation would relish the prospect of an all-out trade war, Malaysian investors are perhaps most at risk...And while it's a TPP member, the accord's demise is the least of Kuala Lumpur's worries. It might even be a short-term boon. After all, the Southeast Asian country is an energy and palm-oil exporter. It's not terribly competitive at much else.... But TPP being dead doesn't help either. For one, dollars are in short supply in the banking system, and therefore a flight to safety among investors jittery about a Trump presidency makes Malaysia a particularly vulnerable emerging market....If fears about a Trump presidency keep exchange rates volatile, and the $5.5 billion of foreign inflows into Malaysian bond markets turn into outflows, hopes consumers will provide a floor to the economy may quickly disappear....

https://www.bloomberg.com/gadfly/articles/2016-11-13/malaysia-s-running-out-of-trump-cards

Foreign banks shaken by Malaysia's move to halt currency slide By Saikat Chatterjee and Praveen Menon | HONG KONG/KUALA LUMPUR -- "There's a massive back and forth going on between banks and Bank Negara Malaysia (BNM) now," said a banker at a foreign bank in Malaysia that deals in foreign currency transactions. "This is a type of indirect capital control ... I see a flood of people exiting Malaysia." ... "We have been told that we cannot repatriate our money and our investments stay in Malaysia if we don't sign," he said. The bankers asked for anonymity, due to the sensitivity of the subject. Foreign holdings account for 40% of the total outstanding bond market in Malaysia, one of the largest foreign ownerships in Asia.... Foreign investors pulled 8.4 billion ringgit out of government bonds in September, the largest outflow since August last year, when Malaysia's markets tumbled on a political crisis swirling around Prime Minister Najib Razak and corruption allegations involving indebted state fund 1Malaysia Development Berhad (1MDB).... In October, however, there were inflows of 2.39 billion ringgit into government bonds, and foreign reserves rose to US$97.8 billion by the end of the month, up from US$97.7 billion at the end of September. The reserves were enough to finance 8.4 months of retained imports.... http://www.reuters.com/article/us-malaysia-fx-controls-idUSKBN13C0M5

Malaysia's Running Out of Trump Cards By Andy Mukherjee -- Amid a deepening emerging-market rout, three of Donald Trump's seven promises to American workers are making Asia particularly nervous.... Although no Asian nation would relish the prospect of an all-out trade war, Malaysian investors are perhaps most at risk...And while it's a TPP member, the accord's demise is the least of Kuala Lumpur's worries. It might even be a short-term boon. After all, the Southeast Asian country is an energy and palm-oil exporter. It's not terribly competitive at much else.... But TPP being dead doesn't help either. For one, dollars are in short supply in the banking system, and therefore a flight to safety among investors jittery about a Trump presidency makes Malaysia a particularly vulnerable emerging market....If fears about a Trump presidency keep exchange rates volatile, and the $5.5 billion of foreign inflows into Malaysian bond markets turn into outflows, hopes consumers will provide a floor to the economy may quickly disappear....

https://www.bloomberg.com/gadfly/articles/2016-11-13/malaysia-s-running-out-of-trump-cards

15 November: Global growth to suffer? Ringgit issues, end of TPPA, Trump's first interview

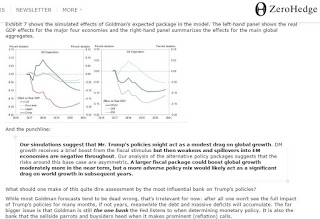

Goldman Just Killed The "Reflation Euphoria" - Concludes Global Growth Will Suffer Under Trump No Matter What by Tyler Durden Nov 14, 2016

What it confirms to us is that the scenario we predicted on November 9, moments after Trump was declared winner, is starting to play out namely that the true state of the global economy - which had been propped up for years with trillions in liquidity - is about to be revealed, and a major global recession, if not depression is in store.

http://www.zerohedge.com/news/2016-11-14/goldman-just-killed-trump-euphoria-concludes-global-growth-will-suffer-under-trump-n Malaysia's business news front page today

Malaysia's business news front page todayCIMB Research: Ringgit could touch 4.80 against greenback within next six months November 14, 2016 http://www.theedgemarkets.com/my/article/cimb-research-ringgit-could-touch-480-against-greenback-within-next-six-months-0?

On Malaysia Ringgit onshore-offshore disparity problem last week, please see excerpt in The Edge Malaysia here. The background from bank treasury experts is this: the non-deliverable forward (NDF) market for Ringgit has always been around since 1998 when Bank Negara Malaysia outlawed offshore Ringgit trading.

I got item below via social media, and it is here http://www.bnm.gov.my/index.php?ch=en_press&pg=en_press&ac=4295&lang=en (please read BNM website version). PRESS RELEASES by BNM - Prohibiting Facilitation of NDF Related Transactions Ref No : 11/16/09 13 Nov 2016: Bank Negara Malaysia would like to state that there is no change in the Foreign Exchange Administration (FEA) rules and there is no introduction of any new measures. Ringgit remains as a non-internationalised currency, thus any offshore trading of ringgit such as ringgit non-deliverable forward (NDF) is not recognized.....

A friend wrote: NDFs are traded in Ringgit and Monetary Authority of Singapore have instructed banks to review their processes because of NDF spot rates manipulation by AAAA and BBBB, including Ringgit and Rupiah.

Another friend checked with AAAA: This is a Jan 2013 case whereby 14 banks were involved, AAAA being one of them. We paid the fine, sacked the traders involved and so did some other banks.

US 2016 results reflect trends seen 2014 and before?

A political analyst I was in touch with pointed out that the media has not been reporting properly. The USA 2014 mid-term election already showing Republican gains. Look at this (image on left and link below)? Plus the "deep state" signs like FBI on the Hillary's email issues.

A political analyst I was in touch with pointed out that the media has not been reporting properly. The USA 2014 mid-term election already showing Republican gains. Look at this (image on left and link below)? Plus the "deep state" signs like FBI on the Hillary's email issues.Trump's first interview as president-elect

As CBS' Lesley Stahl summarized the interview, "what we discovered in Mr. Trump’s first television interview as president-elect, was that some of his signature issues at the heart of his campaign were not meant to be taken literally, but as opening bids for negotiation.

Lesley Stahl: You don’t like it, but your own transition team, it’s filled with lobbyists.

Donald Trump: That’s the only people you have down there.

Lesley Stahl: You have lobbyists from Verizon, you have lobbyists from the oil gas industry, you have food lobby....

Donald Trump: I’m saying that they know the system right now, but we’re going to phase that out. You have to phase it out.

On TPPA

Senate Majority Leader Mitch McConnell and House Speaker Paul Ryan said they would not take up the TPP before Mr Trump's inauguration. The President-elect made his opposition to the TPP a centrepiece of his campaign, saying it would send more jobs overseas. http://www.straitstimes.com/world/united-states/obama-administration-suspends-vote-effort-for-tpp-deal

Surprised to read Japan push through TPPA earlier. The advise from trade experts has been to wait for USA legislators to move first. See news from 4 Nov 2016, Japan Lawmakers Vote to Ratify TPP - Bill was pushed through a special committee after scuffles and shoving on the committee floor http://www.wsj.com/articles/japan-lawmakers-vote-to-ratify-tpp-1478256900

On Michael Moore's analysis and Trumpland

It is amazing how quickly Moore's rational assessment of the election on October 24th has completely devolved into madness as he is blatantly and overtly calling for mass violence. Moore, like other democrats, would be well served to take a step back and consider the fact that the outcome of this election is the direct result of a corrupt DNC rigging the system to nominate a flawed candidate with numerous outstanding criminal investigations....the blame game should end there.

Michael Moore: Trump presidency a 'dangerous' risk - UpFront, Al Jazeera English https://www.youtube.com/watch?v=b_w-iF-cgaQ

Michael Moore: Trump Voters Aren't Racists, Many Voted for Barack Hussein Obama https://www.youtube.com/watch?v=p2ifVTGJDZI

Trump is a con job https://www.youtube.com/watch?v=Yz3jWJVsErc

Michael Moore Explains Why TRUMP Will Win 24 Oct 2016 https://www.youtube.com/watch?v=YKeYbEOSqYc11 November - reflecting on market uncertainty

Emerging market forex drops, USD and US equities gain. Big tax incentives shift money back to US. Fisca lrather than monetary boost to come? Sounds good for USA..Feels like TPPA and vast recent volume of China SOE driven MOUs in the region marks some sort of apex! Social media in KL full of chatter BNM forex intervention. CPO denominated in MYR is heading up as USD strengthens. Offshore USDMYR said be 4.50. I inadvertently used that figure in my spreadsheet last week in forecast view. No inkling of such volatility.

Latest:11/11 BNM governor says Malaysia will not peg ringgit despite recent volatility currency has been facing due to external environment/STARBIZ (please verify)

9 November - Trump victory impact on palm oil

First of all to acknowledge that my husband was correct. He has held the opinion that Trump would win since early this year; his take on Malaysia perspective: https://m.facebook.com/story.

From reader feedback out here: A general agreement on international (Brexit-type) de-globalisation movement?

Read a comment from Henri Bardon: What market pullback? Businessman that has never held political office and wants to reduce tax and regulations.... And from a hard-nosed KL-based investor: Trump is pro-business, noting that TA Enterprise of Malaysia is a Trump business partner.

For palm oil, notable that Trump may be pro-business (lower tax and regulations) but domestic (and Americas region?) trade, business and US jobs oriented:

- Producer-country: Boost existing domestic sentiments that may further agitate for better deals / protection for smallholders. On sustainability, suggesting more rapid reform at elite-oriented programmes needed i.e. further RSPO resourcing reform. Comes in wake of pressured disbandment of IPOP in late 2015 despite record haze on cartel fear. Smallholder outcomes worth tracking and remain to be seen. But TPPA-demanded Malaysia sustainability upgrades including on ILO labour standards on the back burner?

- Destination market issues: Less support for imports of biofuels and other products, sustainable or not. Increased domestic buy and domestic oils focus (already also seen for China). Foodnavigator (below) writes: Dr Marion Nestle to suggest that nutrition, food safety and sustainability may not be high up the policy agenda.

To repeat my early reaction while sitting at RSPO RT14: What are implications of Brexit-Trump victories for sustainability? Review your political-economic structure and mitigate negative economics for small suppliers. https://m.facebook.com/story.php?story_fbid=1273430179375792&id=116785031706985

Some articles and links:

Plantation Sector: Impact of a Trump presidency by Ambank 10 Nov 2016 -- These are the potential effects that we can think of:-

1. No TPPA - President Trump does not support TPPA. USA tax on refined palm oil from Malaysia at about 9.6%... no import duty on crude palm oil.

2. Drop in demand for biodiesel imports?..as renewable energy may not be a priority for his administration (see OGJ below)

3. Indirect impact from weaker RM vs. USD

4. Disruptions in global trade to affect commodities demand? China and currency manipulators.

....It remains to be seen if Trump will carry out his proposals when he starts his job as the new President of USA.

1. No TPPA - President Trump does not support TPPA. USA tax on refined palm oil from Malaysia at about 9.6%... no import duty on crude palm oil.

2. Drop in demand for biodiesel imports?..as renewable energy may not be a priority for his administration (see OGJ below)

3. Indirect impact from weaker RM vs. USD

4. Disruptions in global trade to affect commodities demand? China and currency manipulators.

....It remains to be seen if Trump will carry out his proposals when he starts his job as the new President of USA.

US election results improve prospects for federal policy reforms - Oil & Gas Journal -- The US oil and gas industry’s prospects for reforming federal policies, from arbitrary quotas under the Renewable Fuel Standard to reduced leasing opportunities on the US Outer Continental Shelf, brightened as Donald J. Trump beat Hillary Clinton for the presidency and Republicans kept control of both houses of Congress in the 2016 elections....

http://www.ogj.com/articles/

http://www.ogj.com/articles/

What will a Trump presidency mean for the US food & beverage industry?.. Thus far Trump has not talked much about food policy or agriculture beyond discussing taking SNAP away from USDA and the farm bill, describing the FDA as the ‘food police’ (in a fact sheet later removed from his website), calling for an immediate halt to new federal regulations, and talking of significantly curtailing the powers of the EPA - prompting food policy expert Dr Marion Nestle to suggest that nutrition, food safety and sustainability may not be high up the policy agenda under the Trump administration..... http://mobile.foodnavigator-