Singapore Business Times on 18 March 2014 reported that "market talk revealed that there have been at least three separate parties interested in acquiring Olam during the same period, potentially pushing up its share price as well..... Sime Darby, one of the largest palm oil producers in the world, is said to be one of them. Two Japanese trading companies are also said to be interested in Olam due to its exposure to African markets...." newslink: http://www.businesstimes.com.sg/premium/companies/others/moodys-olam-bid-temasek-credit-negative-20140318

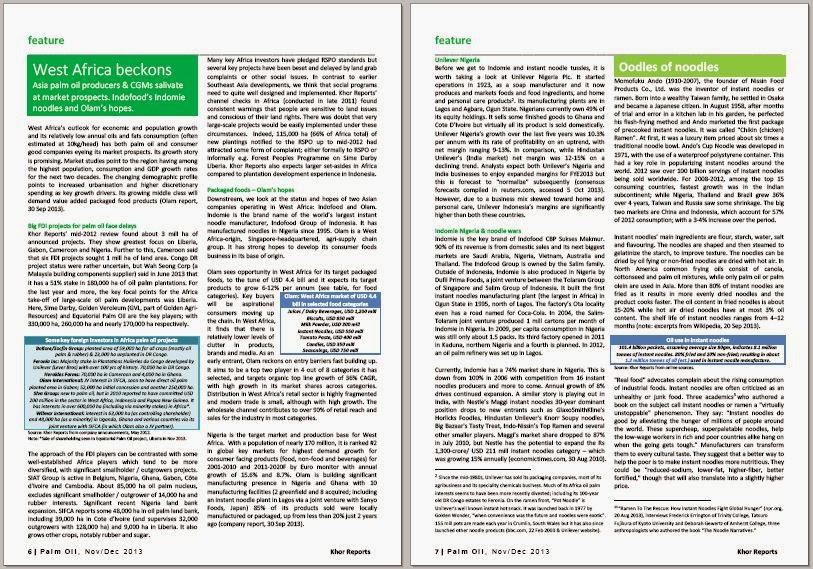

Khor Reports wrote about palm oil prospects in West Africa and two key Asia-based companies tackling the consumer market there - Indofood's Indomie and Olam.

KHOR REPORTS' PALM OIL NOV/DEC 2013, ISSUE 5: Feeding Africa, Asian companies eye West Africa consumers with palm oil, instant noodles and more

Feature: Indomie, Unilever & Olam in W Africa. Instant noodles & global hunger

Indonesia’s landholding ceiling, Felda Global deals & more

Biofuel policy cooling and boost, Neste Oil’s renewables

Sustainability: more certification, snacks & supply chain

Preview: RSPO hot topics

Click here to read: /khorreports-palmoil/2013/11/khor-reports-palm-oil-novdec-2013-issue.html

Olam share price over 5 years (Bloomberg.com):

Other news on Temasek's Olam takeover offer :

Temasek Unit’s Offer for Olam Is Credit Negative, Moody’s Says; By Lisa Pham and Colin Keatinge Mar 17, 2014; http://www.bloomberg.com/news/2014-03-17/temasek-unit-s-offer-for-olam-is-credit-negative-moody-s-says.html; The offer by Temasek Holdings Pte’s unit to take over Olam International Ltd. (OLAM) is credit negative for the Singapore state-owned investment company, according to Moody’s Investors Service. The acquisition, which values one of the world’s top three coffee and rice traders at S$5.3 billion ($4.2 billion), will put pressure on Temasek’s “portfolio liquidity,” Moody’s, which rates the investment firm at Aaa, said in a March 17 report. Olam’s 2 percent dividend yield in 2013 is also lower than Temasek’s return of about 3 percent, it said. “Bringing a new company under the Singapore umbrella negatively pressures portfolio liquidity,” Alan Greene, a senior credit officer at Moody’s, said in the report, which estimates 65 percent of Temasek’s S$215 billion investments are in Singapore dollars.

http://www.bloomberg.com/news/2014-03-16/olam-buyout-caps-55-rally-as-short-seller-block-praises-change.html

http://www.bloomberg.com/news/2014-03-13/temasek-unit-offers-to-buy-olam-in-4-2-billion-cash-deal.html

Other recent news on Olam:

http://www.bloomberg.com/news/2013-11-13/olam-agrees-to-sell-australian-almond-orchards-for-a-200-million.html

Update 20 March 2014: Nomura Research, Olam International (OLAM SP, Buy) - Temasek offer sets the floor ( SGD2.22 / PT: SGD2.50 ) by Tanuj Shori; Bineet Banka. Raising price target — We still see long-term value in the business; we advise shareholders to hold on. Action: Temasek offer sets the floor; in line with recent agri transactions. In an unexpected move on March 14, Temasek’s (unlisted) subsidiary, Breedens Investments (unlisted) proposed an all-cash offer of SGD2.23/share for Olam. While the offer values Olam at ~14x CY14F P/E [~10% premium to peers Wilmar (WIL SP, Neutral) and Noble (NOBL SP, Buy)] and ~9x CY14F EV/EBITDA, it is in line with the recent major transactions in the global agri space (Fig. 11). We raise our TP to SGD2.50.

Khor Reports wrote about palm oil prospects in West Africa and two key Asia-based companies tackling the consumer market there - Indofood's Indomie and Olam.

KHOR REPORTS' PALM OIL NOV/DEC 2013, ISSUE 5: Feeding Africa, Asian companies eye West Africa consumers with palm oil, instant noodles and more

Feature: Indomie, Unilever & Olam in W Africa. Instant noodles & global hunger

Indonesia’s landholding ceiling, Felda Global deals & more

Biofuel policy cooling and boost, Neste Oil’s renewables

Sustainability: more certification, snacks & supply chain

Preview: RSPO hot topics

Click here to read: /khorreports-palmoil/2013/11/khor-reports-palm-oil-novdec-2013-issue.html

Olam share price over 5 years (Bloomberg.com):

Other news on Temasek's Olam takeover offer :

Temasek Unit’s Offer for Olam Is Credit Negative, Moody’s Says; By Lisa Pham and Colin Keatinge Mar 17, 2014; http://www.bloomberg.com/news/2014-03-17/temasek-unit-s-offer-for-olam-is-credit-negative-moody-s-says.html; The offer by Temasek Holdings Pte’s unit to take over Olam International Ltd. (OLAM) is credit negative for the Singapore state-owned investment company, according to Moody’s Investors Service. The acquisition, which values one of the world’s top three coffee and rice traders at S$5.3 billion ($4.2 billion), will put pressure on Temasek’s “portfolio liquidity,” Moody’s, which rates the investment firm at Aaa, said in a March 17 report. Olam’s 2 percent dividend yield in 2013 is also lower than Temasek’s return of about 3 percent, it said. “Bringing a new company under the Singapore umbrella negatively pressures portfolio liquidity,” Alan Greene, a senior credit officer at Moody’s, said in the report, which estimates 65 percent of Temasek’s S$215 billion investments are in Singapore dollars.

http://www.bloomberg.com/news/2014-03-16/olam-buyout-caps-55-rally-as-short-seller-block-praises-change.html

http://www.bloomberg.com/news/2014-03-13/temasek-unit-offers-to-buy-olam-in-4-2-billion-cash-deal.html

Other recent news on Olam:

http://www.bloomberg.com/news/2013-11-13/olam-agrees-to-sell-australian-almond-orchards-for-a-200-million.html

Update 20 March 2014: Nomura Research, Olam International (OLAM SP, Buy) - Temasek offer sets the floor ( SGD2.22 / PT: SGD2.50 ) by Tanuj Shori; Bineet Banka. Raising price target — We still see long-term value in the business; we advise shareholders to hold on. Action: Temasek offer sets the floor; in line with recent agri transactions. In an unexpected move on March 14, Temasek’s (unlisted) subsidiary, Breedens Investments (unlisted) proposed an all-cash offer of SGD2.23/share for Olam. While the offer values Olam at ~14x CY14F P/E [~10% premium to peers Wilmar (WIL SP, Neutral) and Noble (NOBL SP, Buy)] and ~9x CY14F EV/EBITDA, it is in line with the recent major transactions in the global agri space (Fig. 11). We raise our TP to SGD2.50.