source: Screenshots from HCS Science Study Draft Synthesis Report

Source: Images from HCS Science Study Draft Synthesis Report

with annotations by Khor Reports palm oil blog on key policy features

Key points include:

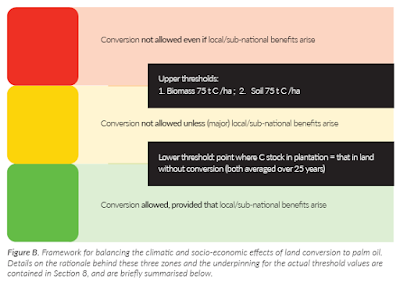

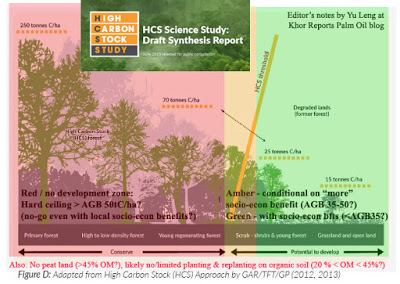

- The Sustainable Palm Oil Manifesto’s** HCS+ Science Study "Draft Synthesis Report" proposes oil palm development threshold ceiling for development and a traffic light warning system:

- Green / “may develop” zone is AGB 35-40tC/ha or better (being oil palm equivalent and requiring socio-econ benefits)

- Amber / “may develop if” zone (requiring more local socio-econ benefits) is AGB 35-40 to 50tC/ha. Offsets involved?

- Red / no development zone (not allowed even if there are socio-econ benefits) is AGB 50 tC/ha and above

- It seeks to protect “advanced growth secondary forests” which typically has AGB of 100t/ha (50tC/ha) and more after 20 years. Thus, no matter what the local socio-economic benefit, the target is that 20 year old tropical trees should be protected.

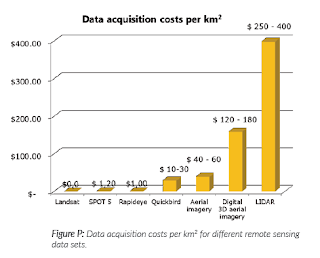

- For AGB measurement, the LIDAR method is proposed. The cost estimate is $2.50 to $4 per ha; for 10,000 ha that is $25,000 to $40,000.

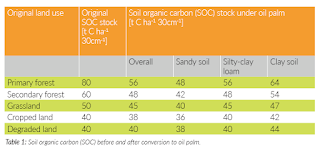

- It has a separate and additional soil carbon protection criteria. The threshold is set at 75 tC/ha equivalent . This means max 12.5 cm depth for tropical peat lands and max 12.5 cm to 37.5 cm for tropical organic soils. Experts say there are no major zones of non-peat organic soils in Malaysia, although there are some coastal (non peat) wetlands. Some sustainability specialists note that this would restrict oil palm planting on organic matter rich mineral soils – possibly, newly deforested zones may have such a layer of organic matter? Also, this may strongly affect the ability to replant oil palm in peat zones i.e. no replanting? (Editor's note, 9 July: some consultants are surprised that the palm oil industry expected to replant on peat land)

** Key palm oil companies: Asian Agri, Cargill, IOI Corp, KL Kepong, Musim Mas, Sime Darby, Wilmar; A steering committee (SC), independently co-chaired by Founder Director of Forum for the Future, Sir Jonathon Porritt, and Chief Research Scientist from Australia’s Commonwealth Scientific and Industrial Research Organisation (CSIRO), Dr John Raison, has been established to oversee the HCS Study. Members of the Steering Committee represent key players in the palm oil value chain which includes the signatories of the Manifesto as well as Wilmar International. They are joined by independent economic advisor for the agribusiness sector, Dr James Fry, Chairman of LMC International, who lends his expertise in international commodities to the process. Observers include representatives from the RSPO, Sustainable Trade Initiative (IDH), Neste Oil and several other organizations (in the process of joining) who will actively contribute to ensure a transparent, objective and holistic approach... http://www.carbonstockstudy.com/carbonstockstudy/media/Documents/HCS-Study-Description-Paper.pdf

The threshold – ceilings for agriculture development:

Above Ground Biomass or AGB + Below Ground Biomass or BGB (i.e. roots) + dead wood

With this total divided by two to get to carbon per hectare C/ha measure.

Thus: (100 + 100* 0.25 + 100* 0.25) / 2 = c.75 tC/ha ceiling for any development.

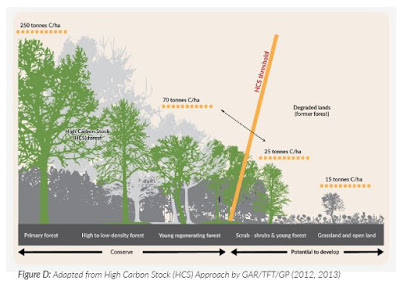

It is handy to refer to already familiar measures used by the RSPO GHG WG and also the TFT / Greenpeace HCS Approach. They do not include measure of BGB roots and litter or dead wood; and both have mentioned 35tC/ha as palm oil equivalent#.

# RSPO has a New Planting Procedure GHG emissions reduction policy where differential values prompt plantation developers to reduce their use of HCS zones. The traceability regimes under TFT/Greenpeace have stepped down from the 35tC/ha starting point; and plantation sustainability specialists reckon that the effective ceiling is a higher figure c. 70-90 tC/ha. Some background here: “Manifesto 5 stepping up efforts (update 5): The tussle over HCS and 35tC/ha” 7 October 2014: So what was the 35tC/ha ceiling? In our talks to specialists, that is the life-time average carbon of the oil palm tree (it is referred to in a key RSPO working group document too); thus NGOs said that to be carbon neutral in some sense, oil palms should not be developed in forested areas with more than its own above ground carbon value. Of course, even the oil palm carbon measure is contested - do you include the fronds, fresh fruit bunches and ground cover etc? You may also ask why a crop is compared to trees - some say that may have been inadvertently abetted by some in the industry claiming that the oil palm is as good as a (forest) trees in the first place. Thus, solidifying the tree basis of comparison (which does not apply to other oilseed crops?)…. So what will be the basis of "no deforestation"? A higher ceiling? Earlier, some spoke of 100tC/ha as a possibility. Some stepped up pledges have added parameters, such as Wilmar's (via a TFT traceability program) which has a multi-year no human use caveat. Individual B2B traceability programs may have varying parameters compared to the multi-stakeholder efforts such as the RSPO-based… Read more, /khorreports-palmoil/2014/09/high-carbon-stock-studies-underway.html And “Over 1000tc/ha carbon stock in one oil palm cycle,” 20 Nov 2013, /khorreports-palmoil/2013/11/over-1000tcha-carbon-stock-in-one-oil.html - if you divide 1000 / 25 years (of the economic life of the oil palm tree) to reach the average of 40tC/ha for oil palm equivalent. Notably, some point to a measure higher than 1000 for the oil palm cycle.

On AGB terms, the HCS+ Science Study proposes a (hard?) ceiling for development at 50 tC/ha for any corporate and corporate-led smallholder development as "conversion not allowed even if local / sub-national benefits arise” in this red / no-go zone. This appears relatively tough. The TFT/Greenpeace HCS Approach is reckoned by some experts to be operationalised at c. 70tC/ha plus*.

*but some differences of opinion highlight the important ambiguities existing

The HCS+ Science Study continues firmly in the tradition that palm oil sustainability is rooted in forestry conservation principles. This was established at the RSPO and also used at TFT/Greenpeace. Specialists point to their origins in the Forest Stewardship Council’s definition and approaches.

So what trees does the HCS+ Science Study seek to protect? “Advanced growth secondary forests”: these are forests have an AGB of 100t/ha and more. Divide by two (to get to C), you reach the AGB 50tC/ha apparent hard ceiling of no development (no matter what the local socio-economic benefit) to protect 20 year old tropical trees (accumulating 5 tonnes C per year).

What is soil 75 tC/ha equivalent to in range of depth terms? Est. 12.5 cm depth for tropical peat. “a typical tropical peatland has per ha a carbon stock of 6 tons per cm of peat depth. A lower soil carbon threshold of 40 t C ha-1 (the ‘palm oil equivalent’) then translates in a peat layer of 6.7 cm thick”; 122. This means that tropical organic soils always surpass an uppermost 75 t C threshold value when they have an organic layer of more than 37.5 cm thickness, whatever its organic matter content may be, and mostly this is achieved with a thickness of 12.5 cm.

source: Screenshots from HCS Science Study Draft Synthesis Report

The comments below focus on the threshold implications for socio-economic development. It also offers preliminary feedback from several senior industry experts on technical issues and macro trends. Clearly, myriad questions as well as overlapping concerns about an apparent policy halt for oil palm development.

As of 10 July 2015 (update 2), feedback below compiled from 11 people. Please send us your feedback, but more importantly do contribute to the Public Consultation on this Report (Feedback Form: http://www.carbonstockstudy.com/Public-Consultation/Feedback-Form).

Socio-economic issues:

source: Screenshots from HCS Science Study Draft Synthesis Report

- While the wording suggests no corporate-led smallholder development would be allowed in red zones, it is not clear if state-led (non-private sector corporations) smallholder development and independent smallholder development would be acceptable.

- It is so far silent on what a 50tC/ha ceiling looks like in say Papua or West Africa. What is the population in red / no development zones and what are their current incomes and aspirations? What happens to the people residing therein? Can they plant other crops or undertake other economic activities? Does this point to out-migration?

- The amber zone (corporate development allowed conditional upon including “major local / sub-national benefits” to local peoples) is set at a range of AGB 35-40 to 50 tC/ha, and corporate plantation development is green lighted (“provided that local / sub-national benefits arise”) if it is below the oil palm equivalent of AGB 35-40 tC/ha. What implementers will be asking: what are acceptable “major local benefits” (amber HCS zone) and what are “local benefits” (green HCS zone).

- Industry is surprised that the HCS+ Science Study proposes the same thresholds across all global geographies. Perhaps this is because climate science policy has been its focus so far, while socio-economic implications have yet to be undergo modelling and sensitivity analysis. There had been an expectation that different thresholds would apply to create room for West Africa development, so the red / no-go zone of AGB 50tC/ha for Africa smallholder development seems a surprise.

- Test modelling of these proposals would be useful, to find out what the proposed AGB 50tC/ha threshold mean in key future oil palm zones – does it set aside 50%, 60%, 70% or 80% of a region for forest conservation?

- While plantation groups and others in the supply-chain are keen to set an “orderly (global) oil palm development policy,” there will be local impacts and local questions. What happens to the people residing in the “red / no development” zones? Can they grow other (tree) crops? What alternative development activity and income opportunity for them? Can they migrate to (and can they be absorbed in) zones set by HCS+ thresholds as green and amber?

- Update 1, 9 July: Is there some caveat to cross into the red zone? Can this still be discussed or is this "draft" near final?

On technical issues:

- Do the assumed rates, including the 5 tonnes C accumulation per year need to be rechecked? Readers point out that it seems there was no time to do research, but that relies on existing scientific literature.

- Why is carbon from trees assumed immediately as emissions when in fact a significant portion of the timber may remain is in use (carbon fixing)? What about carbon in the oil palm FFB (whether on production basis or FFB stock in tree), and is the return of EFB to the field measured?

- Why LiDAR? There are more cost effective methods.

- If organic-rich (fertile) mineral soils are restricted in use, what is the implication on carbon emission if more fertilizers are needed to plant on less fertile mineral soils?

- "As a first reaction, I am very perturbed by Item 68 wherein a single paper by Cowenburg and Hoojer (2013) has been quoted as the basis for the proposition. This paper is a follow-up to an earlier paper by Hoojer et al (2012), which is so full of technical weaknesses and unjustified assumptions …. (it is a) questionable data source...." [Editor's note. HCS Science Study: Draft Synthesis Report, 68. Outcome 2: No development involving new or deeper drainage of peat and other highly organic soils. Emissions from drained peat upon conversion are very high (about 17 t C/ha/yr, or 425t C/ha over a 25 year period; Cowenburg and Hoojer, 2013). High emitting soils thus need to be identified and excluded from plantation development. We propose a soil carbon threshold that is expressed in terms of net emissions, and that is equivalent to the biomass threshold (75 t C/ha). The soil threshold thus allows a net loss of soil carbon of a maximum of 75 t/ha over the crop rotation]

- "The logic of certain assumptions and scientific justification of some of the quantitative figures need to be questioned/rebutted....”

- Update 1, 9 July: This HCS study figure differs from RSPO's 36 t C/ha. The hard threshold of 50 t C/ha appears too low and very little degraded forest will be available for oil palm especially if RSPO takes it up and backdates it to 2005. Does this study, take the starting point as the day the concession is taken over (or what cut-off date?). Why do the thresholds vary? Basically, consultants for oil palm biomass make different assumptions. Some assume oil palm carbon growth is a straight line and take a simple arithmetic mean. But, some argue otherwise i.e. oil palm grows very fast during the early years when there is no self-shading and competition before slowing down. Thus, the integration method (add up biomass for each year and divide by the number of years) works out a different mean value. The difference can be as high as 10 t C/ha. That is why RSPO got a figure of 36 t C/ha. [Editor's note: Cut-off dates matter as AGB carbon accumulates each year. However, we have heard that where there is divergence between AGB carbon between say the RSPO 2005 cut off and the current AGB carbon level, the higher of the two has been used (i.e. auditors are conservative). New programs such as TFT/Greenpeace traceability programs create new cut-off dates e.g. Wilmar's is in December 2013 versus RSPO's 2005 benchmark).

- Update 1, 9 July: Report looks rushed - some obvious errors. Can the Report clearly explain any data biases and ambiguities it may have. We need a better, more thorough and nuanced consideration of these. This reads as rather simplified. Has each data point been carefully considered? Is there a range of values? Are there enough appropriate data sources?

- Update 2, 10 July: On the peat / organic soil question [Editor's note: Given reader interest in the peat question, we reproduce below key excerpts about the peat and organic soil carbon problem and definitions from the Draft Synthesis Report. It seems that the main focus of the Report may be on peat having >45% OM. This can be contrasted with some plantation company policies which define peat as soil with >65% OM. Notably, plantations have not referred to organic-rich soils as being potentially unplantable; this appears to be defined as 20%-45% OM by the Report? The conclusion: "This means that all tropical peatlands, whatever their definition with respect to minimum peat thickness, surpass the uppermost HCS+ threshold value. Therefore, the HCS+ approach merely has to identify the presence of peatlands, not their total soil carbon stock." From item 120: "For the tropics, Wüst et al. (2003) distinguish between ‘peat’ (with > 45 % organic matter OM), ‘muck’ (35 % < x < 45 % OM), ‘organic-rich soil sediment’ (20 % < x < 35%) and ‘mineral soil or sediment’ (<20 % OM)...." - see below for more].

- Update 2b, 22 July: From a reader on RSPO definition and limitations of peat, "Tropical peat soils are defined in the RSPO Peat BMP Manual as organic soils with 65% or more organic matter and a depth of 50cm or more."

Other macro questions:

- Agriculture is said to account for 8% of anthropogenic (man-made) carbon emissions. How much comes from palm oil?

- By significantly slowing (possibly near halting?) palm oil with a 50tC/ha ceiling, what is aggregated impact after other oils expand? What about a carbon per tonne oil measure?

- "This appears biased towards killing off expansion of oil palm probably in favour of soyabean and rapeseed oil. I do not agree with many things in the write-up. Unfortunately, all the big players agreed to this study. If we accept this, we might as well stop oil palm development...." Note: Perhaps it would be useful to look at tC per tonne oil (and other measures) for the next 10 million tonnes under different oil supply scenarios?

- "There is an ominous possibility that this may be developed later to affect replanting on mineral soils under the strategy of “HCS compensation” i.e. growers, notably the big 'boys', will be required to set aside a significant area for high-intensity reforestation for continued (RSPO?) certification and market access. In other words, the industry will not only cease to expand but also start to shrink... For peat, no new areas can possibly satisfy the stringent criteria and replanting of existing areas at the end of the current cycle can definitely be ruled out...."

- "Item 256 is particularly appalling. If this is the ultimate conclusion, then the sociological considerations and propositions in the Report merely constitute a 'red herring' - a big one at that! What I perceive is a very subtle strategy to push through a forestry-cum-peat conservation agenda right under the "noses" of the industry! Overall, the HCS concept and strategy may well spell the death-knell for any legitimate expansion for the industry (anywhere)." [Editor's note. HCS Science Study: Draft Synthesis Report, 256. All peat and other organic soils have to be excluded from conversion. All land with mineral soils, and an AGB < 100t/ha are eligible for conversion, unless drainage associated with their conversion would adversely affect the protection of adjacent peat and organic soils. [Editor's note: AGB < 100 t/ha is equivalent to AGB < 50 tC/ha]]

- "To me, the issue is where the threshold is set."

- Update 1, 9 July: The palm oil industry approach to NGO concerns is still evolving after all this time. It looks like another round of NGO criticisms of the big players.

This document is in public consultation, and you can read and submit your feedback by 31 July 2015 via these links:

- Draft Synthesis Report: http://www.carbonstockstudy.com/Public-Consultation/Draft-Synthesis-Report

- Feedback Form: http://www.carbonstockstudy.com/Public-Consultation/Feedback-Form

..............

Update 2, 10 July 2015 - on the peat / organic soil question

Editor's note: Given reader interest on the peat / organic soil question, we reproduce below key excerpts about the peat and organic soil carbon problem and definitions from the Draft Synthesis Report. It seems that the main focus of the Report may be on peat having >45% OM. This can be contrasted with some plantation company policies which define peat as soil with >65% OM. Notably, plantations have not referred to organic-rich soils as being potentially unplantable; this appears to be defined as 20%-45% OM by the Report? The conclusion: "This means that all tropical peatlands, whatever their definition with respect to minimum peat thickness, surpass the uppermost HCS+ threshold value. Therefore, the HCS+ approach merely has to identify the presence of peatlands, not their total soil carbon stock."

From item 120: For the tropics, Wüst et al. (2003) distinguish between ‘peat’ (with > 45 % organic matter OM), ‘muck’ (35 % < x < 45 % OM), ‘organic-rich soil sediment’ (20 % < x < 35%) and ‘mineral soil or sediment’ (<20 % OM).

Excerpts from the Report

Brief primer on carbon storage and carbon dynamics in vegetation and soils; 8. The vulnerability of soil C stocks to loss following disturbance varies to a great extent. Loss from drained peat is very high whether caused by microbial oxidation or fire. Losses from microbial oxidation after drainage of peat are of the order of 17 t C/ha/yr. C losses from other (non-peat) organic rich soils can also be very high.

117. The paradigm example of carbon-rich soils are peatlands. However, no globally accepted definition of peatland exists. Peatlands have variously been defined as having a minimum peat layer of 20, 30, 45, 50 or 70 cm thick (Agriculture Canada 1987). These numbers have their background in land use and reflect standard plough depths, thickness before consolidation, and suitability for peat extraction, respectively. Recently, the Indonesian Climate Change Centre proposed for mapping purposes a minimum peat depth of 50 cm2. None of these definitions have been informed by climate relevance. In the HCS+ approach the latter aspect must, however, have a central position.

118. With a conservative carbon density of 0.06 g cm-3 (Dommain et al. 2011; Warren et al. 2012), a typical tropical peatland has per ha a carbon stock of 6 tons per cm of peat depth. A lower soil carbon threshold of 40 t C ha-1 (the ‘palm oil equivalent’) then translates in a peat layer of 6.7 cm thick. This means that isolated, very shallow peat covered soils can be converted with little climate concern.

119. An upper soil carbon threshold of 75 t C /ha translates in a peat depth of 12.5 cm. This means that all tropical peatlands, whatever their definition with respect to minimum peat thickness, surpass the uppermost HCS+ threshold value. Therefore, the HCS+ approach merely has to identify the presence of peatlands, not their total soil carbon stock.

120. Whereas the typical Southeast Asian peat largely consists of organic matter, other peats may hold substantial mineral material. Again, ‘peat’ has not been internationally standardised but has, depending on country and discipline, been defined as requiring a minimal content of 5, 15, 30, 50, 65% or more (dry mass) of organic matter (cf. Andrejko et al. 1983, Agriculture Canada 1987, Driessen & Dudal 1991, Succow & Stegmann 2001). For the tropics, Wüst et al. (2003) distinguish between ‘peat’ (with > 45 % organic matter OM), ‘muck’ (35 % < x < 45 % OM), ‘organic-rich soil sediment’ (20 % < x < 35%) and ‘mineral soil or sediment’ (<20 % OM). The threshold between organic and mineral soils is in most classification systems between 20-35 % OM (~12-20 % organic carbon; cf. Wüst et al. 2003). The latter definition is largely in line with the definition of ‘organic soil’ of FAO and IPCC (see below). The World Reference Base for soil resources (WRB 2014) uses a minimum of 20 % organic carbon (~ 35 % OM) to qualify as an organic soil. The commonly referred to FAO definition of ‘histosol’ (1998, 2006/7) is rather complex: It refers not only to the thickness of soil layers and their organic content but also to their origin, underlying material, clay content and annual period of water saturation.

121. The amount of soil organic matter (SOM) is commonly expressed as a percentage of the dry bulk weight of a soil. This weight percentage does not translate linearly into the climatically more relevant carbon density Cd, as SOM is lighter than mineral soil components. The lower boundary for carbon content of an FAO organic soil is 18% by weight in a soil otherwise consisting of clay. The bulk density of this soil is about 0.14 g cm-3 (Ruehlmann & Körschens 2009), which means the Cd is 0.026 g cm-3. Increased amounts of SOM result in lower dry weight and consequently Cd is calculated as a higher percentage of a lower weight. As a result, Cd decreases to 0.024 g cm-3 for a carbon content of 30% and then increases to 0.06 g cm-3 for a purely organic soil (57% C; see above). So the Cd of an organic soil with admixture of clay is always higher than 0.02 g cm-3. The value of 0.02g cm-3 corresponds to the lowest values in the analysis of Warren et al. (2012) on Indonesian peat soils. For such soils, a lower threshold of 40 t C ha-1 would be achieved with an organic soil thickness of 20 cm, an upper threshold of 75 t C ha-1 with a thickness of 37.5 cm (Figure L). When sand is mixed in, the bulk density of the soil is much higher and Cd is never below 0.06 g cm-3 (Figure L).

122. This means that tropical organic soils always surpass an uppermost 75 t C threshold value when they have an organic layer of more than 37.5 cm thickness, whatever its organic matter content may be, and mostly this is achieved with a thickness of 12.5 cm.

References cited in draft report specifically mentioning "peat" in titles include:

- Andriesse, A.J. (1988). Nature and management of tropical peat soils. FAO Soils Bulletin 59, FAO Rome. [online] Available at: http://www.fao.org/docrep/x5872e/x5872e00.htm#Contents [Accessed 12 Jun 2015]

- Ballhorn, U., Jubanski, J., Siegert, F. (2011). ICESat/GLAS data as a measurement tool for peatland topography and peat swamp forest biomass in Kalimantan, Indonesia. Remote Sensing 3:1957–1982.

- Couwenberg, J., Hooijer, A. (2013). Towards robust subsidence-based soil carbon emission factors for peat soils in south-east Asia, with special reference to oil palm plantations. Mires and Peat, 12, Article 01, 1–13.

- Dommain, R., Couwenberg, J., Joosten, H. (2011). Development and carbon sequestration of tropical peat domes in south-east Asia: links to postglacial sea-level changes and Holocene climate variability. Quaternary Science Reviews 30: 999-1010.

- Englhart, S., Jubanski, J., Siegert, F. (2013). Quantifying Dynamics in Tropical Peat Swamp Forest Biomass with Multi-Temporal LiDAR Datasets. Remote Sensing, 5(5).

- Jaenicke, J., Rieley, J.O., Mott, C., Kimman, P., Siegert, F. (2008). Determination of the amount of carbon stored in Indonesian peatlands. Geoderma 147:51–158.

- Lähteenoja, O., Ruokolainen, K., Schulman, L., Alvarez, J. (2009). Amazonian floodplains harbour minerotrophic and ombrotrophic peatlands. Catena 79:140–145.

- Lawson, I.T., Kelly, T.J., Aplin, P., Boom, A., Dargie, G., Draper, F.C.H., Hassan, P.N.Z.B.P., Hoyos-Santillan, J., Kaduk, J., Large, D., Murphy, W., Page, S.E., Roucoux, K.H., Sjögersten, S., Tansey, K., Waldram, M., Wedeux, B.M.M., Wheeler, J. (2014). Improving estimates of tropical peatland area, carbon storage, and greenhouse gas fluxes. Wetlands Ecology and Management 10.1007/s11273-014-9402-2.

- Phillips S, Rouse GE, Bustin RM (1997) Vegetation zones and diagnostic pollen profiles of a coastal peat swamp, Bocas del Toro, Panama´. Palaeogeogr Palaeoclim Palaeoecol 128:301–338.

- Warren, M.W., Kauffman, J.B., Murdiyarso, D., Anshari, G., Hergoualc’h, K., Kurnianto, S., Purbopuspito, J., Gusmayanti, E., Afifudin, M., Rahajoe, J., Alhamd, L., Limin, S., Iswandi, A. (2012). A cost-efficient method to assess carbon stocks in tropical peat soil. Biogeosciences 9: 4477–4485.