21 May 2015: TFT suspends Golden Agri takes (and hours later a new chief sustainability officer is appointed for the plantation giant - Agus Purnomo)

Key issues and questions arising from Golden Agri / PT Smart's present situation:

- Despite innovative industry attempts to promote traceability as a more inclusive solution (versus RSPO which struggles to include small producers and independent smallholders) while heightening key pledges such as "no deforestation, no peat and no exploitation," recent events raise the question of whether producers can live up to promises ("hastily made" according to many key industry players).

- Is palm oil entering a renewed phase of boycott risks? At the SIIA Singapore Dialogue, several IPOP members sat on a panel where Wilmar made a public pledge that it would (if told by other IPOP members) stop buying from any "errant suppliers" who were unable to make the necessary upgrade moves (and if it found such, it would stop buying; tell its fellows and request they would do likewise). Other panelists suggested more focus on constructively working with suppliers for improvement rather than boycott. If agreed, the IPOP "supplier boycott" proposal should give some teeth to the group. But it seems that IPOP members are not clear of the boycott risk themselves; with Golden Agri, a lead member itself now facing RSPO censure and TFT suspension.

- Many industry players regard the shift to TFT B2B traceability as part of a processor-trader led move to find a more business-ready solution (that now seeks to shift the centre of gravity to refinery "supply sheds"; away from the RSPO mill and supply base P&C and RSPO's relatively costly physical supply chain SCCS outlook). The palm oil supply chain has since the mid 2000s been spending time and effort via NGO service providers, auditors and their newly established sustainability teams.

- Industry watchers have been concerned about how widely known implementation gaps among the top highly rated traceable plantation groups will be treated by the broader NGO sector. Clearly, business life is hardly straight forward and the current issues suggest that there is no place for over-confidence and complacency while using new solutions. It seems we are entering a "third wave" where social issues and implementation will be primary - but have the big plantation groups put in enough resourcing to upgrade their implementation efforts to their pledges?

News link:

Golden Agri takes another hit as sustainability guru suspends its membership by Philip Jacobson May 20, 2015; The charity that Indonesia's Golden Agri-Resources has enlisted to devise and implement its zero-deforestation and community-engagement commitments suspended its cooperation with the palm oil giant yesterday, following "several breaches" of the policies they had designed together, according to The Forest Trust (TFT), which helps companies run responsible supply chains. A few hours after TFT announced the suspension, Singapore-listed Golden Agri said in a statement that its chief sustainability officer, Peter Heng, had resigned "to pursue new career opportunities." His replacement is Agus Purnomo, who has headed one of Golden Agri's Indonesian subsidiaries, Sinar Mas Agro Resources and Technology (Smart). Smart's own subsidiary, Kartika Prima Cipta, became the subject of a formal complaint against its operations last year after Golden Agri filed to expand its plantations in 18 of its subsidiaries including Kartika Prima, despite evidence that Kartika Prima had taken community land without residents' informed consent, failed to properly conduct a high-conservation value (HCV) assessment and more. The grievance was lodged by the Forest Peoples Programme (FPP), a UK-based NGO, with the Roundtable on Sustainable Palm Oil (RSPO), the industry's largest voluntary certification scheme. Though TFT was vague in its announcement, the suspension is almost certainly a response to what is apparently seen as Golden Agri and Smart's lackluster handling of the RSPO complaint, which takes on additional importance because Kartika Prima is piloting Golden Agri's sustainability commitments. The RSPO upheld the complaint in March and earlier this month prohibited Golden Agri from "acquiring or developing any new areas" pending its resolution.... Read more: http://news.mongabay.com/2015/0520-jacobson-tft-suspends-golden-agri.html#ixzz3aj9U4zFv

16 May 2015: It's not plain sailing for plantations who've gone in with the "second wave" of heightened "three nos" on peat, deforestation and exploitation

It's not plain sailing for plantations who've gone in with the "second wave" of heightened "three nos" on peat, deforestation and exploitation. Sector risk is of a "third wave" of rather tough to resolve social issues, which may be heightened due to the HCS / high carbon stock regimes coming into play.

The Roundtable on Sustainable Palm Oil (RSPO) has prohibited Golden Agri-Resources (GAR), one of its most prominent members, from "acquiring or developing any new areas" pending the resolution of a formal complaint against the palm oil giant in Indonesia's West Kalimantan province. The decision by the RSPO, the world's largest voluntary certification scheme for palm oil, is a stern directive from an organization that has been criticized for failing to take action against companies that flout its standards.... Read more: http://news.mongabay.com/2015/0508-jacobson-rspo-complaint-gar-fpp.html#ixzz3a19AYBFj<<a%20href=>">http://news.mongabay.com/2015/0508-jacobson-rspo-complaint-gar-fpp.html#ixzz3a19AYBFj

16 Jan 2014:

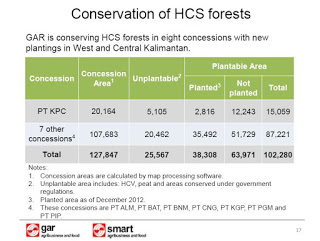

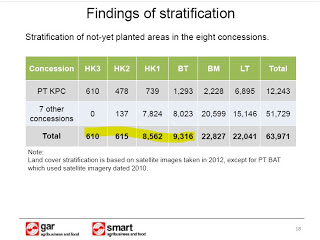

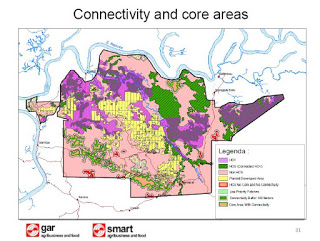

Khor Reports comment: Plantation partnership deals with some NGOs does not preclude good implementation and monitoring by other NGOs. GAR/Sinar Mas had faced boycotts and enlisted TFT-Greenpeace to help (Wilmar is now also signed up on TFT-Greenpeace HCS Approach and other principles). Now, plantation planners should prepare for larger set-aside areas for their new plantings.

The latest news on GAR from a study by Forest Peoples Program / FPP (see news links) highlights some problems of high carbon stock (HCS)/social implementations of the new policies of TFT-Greenpeace for GAR. GAR said, “We thank FPP for their additional findings which have assisted our own full field audit of PT KPC, conducted in partnership with The Forest Trust.” Separately, APRIL and RGE are under pressure from Greenpeace.

News: http://www.eco-business.com/news/golden-agri-april-under-fresh-scrutiny-unsustainable-practices/