Khor Reports: HCS implies net

area of 45% for Kalimantan plantations?

This

morning, GAR and SMART made an announcement on its implementation of its pilot

on High Carbon Stock (HCS) forest conservation. Here is Khor Reports’ quick review

of GAR/SMART’s HCS issues and implications for the palm oil industry.

For the pilot,

“HCS is defined as comprising BT, HK1, HK2 and HK3 areas”. Thus, all types of

forest (high, medium and low density) as well as old scrub lands cannot be

developed. Only “young scrub” and “cleared / open land” can be utilized. Thus, despite

industry rumours of a higher ceiling that would be less of a constraint for oil

palm development, it appears that the NGO-preferred 35tC/ha ceiling still

applies. GAR/SMART’s preliminary study in June 2012, which was done together

with certification facilitator The Forest Trust and Greenpeace, found the weighted

average carbon stock in four Kalimantan concessions in degraded lands in tC/ha:

17 in cleared / open land, 27 in young scrub, 60 in old scrub, 107 in low

density forest, 166 in medium density forest, and 192 in high density forest.

a)

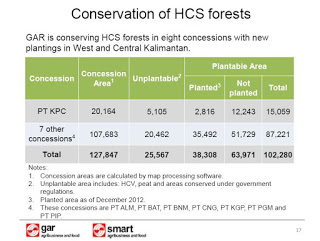

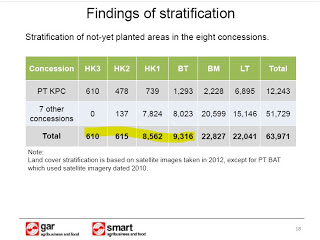

In unplanted

areas, 19,103 ha to be set aside for HCS (highlighted with yellow marker on slide #18). Add on 25,567 ha unplantable for reasons

of HCV, peat and government regulations (slide #17). Total of 35% set-aside area of total

concession.

b)

Add on (minimum)

20% area for smallholder / plasma schemes. The net area for the plantation / nucleus

could be 45%?*

* And this is in partially developed concession areas; area usable

in “new” concession areas could be lower assuming some HCS inadvertently cleared

in the past.

source: "GAR and SMART implement pilot on High Carbon Stock forest conservation"

With this ground-truthing

of satellite image mapping for Kalimantan degraded areas, NGOs may be more

confident to make advanced (and even historical) studies to inform plantation

companies on estimated HCS set asides they should have (or might have had) in

place. As we have mentioned before, we think this is a pre-cursor to a push for

rural land use planning which has been generally lacking in Southeast Asia. NGOs

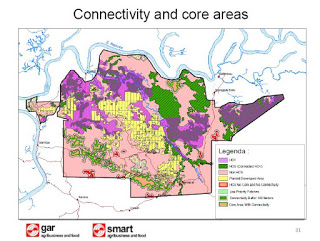

appear well advanced in using satellite imagery for studying oil palm developments. Other issues arising would be connectivity of HCS areas and the need for 100 meter connectivity buffer corridors (see slide #31 below).

source: "GAR and SMART implement pilot on High Carbon Stock forest conservation"

The HCS

ceiling is fundamental to arresting deforestation. It seems a low key issue,

but it will be a thorny question for plantations on the usability of their land

banks. Elsewhere, Norway (population 4.9 million) has also been highlighting

concerns about palm oil’s impact on deforestation, perhaps in less impactful

but highly symbolic ways; weblink:/khorreports-palmoil/2013/03/norway-goes-cold-on-palm-oil.html

Also refer to Khor Reports on details of preliminary HCS report findings in GAR/SMART-TFT-Greenpeace report: Khor Reports Palm Oil Strategic Analysis #7, 11 June 2012, "Carbon Stocks Study Presages Problems for Plantations." Ask for a copy if you don't have it yet.

Info source: Golden

Agri-Resources Ltd: "GAR and SMART implement pilot on High Carbon Stock forest

conservation," 13 March 2013.